Why Long-Term SaaS Revenue Growth Rates are Slowing; and What it Means for Your Private B2B SaaS Company

Median revenue growth rates of publicly traded Software-as-a-Service (SaaS) companies in the SaaS Capital Index™ (SCI) are decelerating, and have been for much of the past decade as these companies grew bigger. The more recent development is that growth rates are now decelerating for all company sizes, including smaller public companies, which historically had the highest growth rates in the Index. In the following post we cover these four key points:

- Revenue growth rates are decelerating for public SaaS companies, in keeping with an established trend as companies mature: bigger companies grow slower on average.

- However, since 2022, revenue growth rates have slowed for all sizes of public SaaS companies, something that cannot be explained by size alone.

- Some mix of financial market pressure and software buyer behavior is likely the cause of these headwinds.

- SaaS companies who will need access to financing likely need to consider a lower burn / higher profitability path in order to be attractive.

SaaS Revenue Growth Rates Are Decelerating

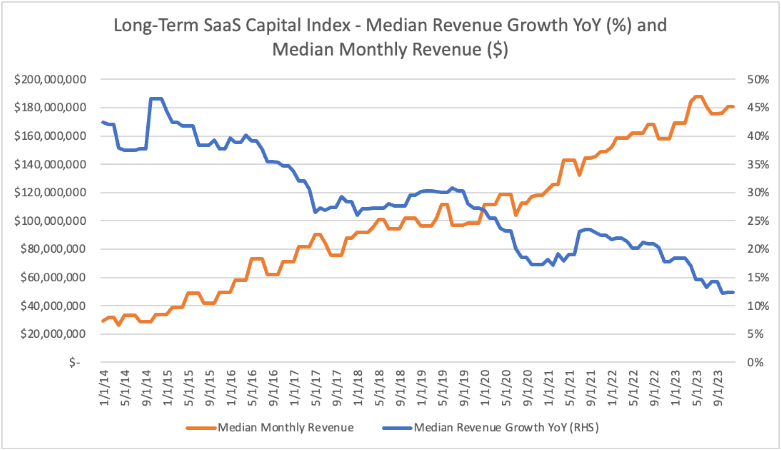

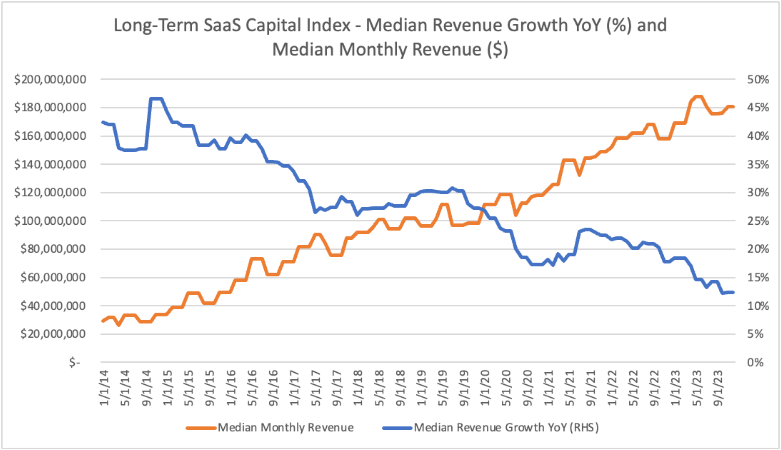

After experiencing a temporary re-acceleration in 2021, median revenue growth rates for public B2B SaaS companies have resumed their decade-long deceleration. This is true if we look at the entire SCI as well as the Long-Term SCI (LTSCI – the companies in the SCI as of January 2014 that remain in the SCI today).

Meanwhile, the size of companies in the Index has steadily increased. Since 2014, the SCI median monthly recurring revenue has grown from around $25 million to $60 million, while the LTSCI median monthly recurring revenue has grown from around $30 million to $180 million. The significant increase in revenue size in the SCI/LTSCI is due to two factors. The first is that older Index companies (e.g. Adobe, Autodesk, and Salesforce) continued growing over time, causing a natural increase in median Index revenue. The second factor is the “staying private for longer” phenomenon, where in the late 2010s private B2B SaaS companies (e.g. Datadog, Snowflake, Qualtrics, and Zoom) delayed going public and instead remained private and raised multi-billion dollar late-stage private equity rounds. By the time these companies did go public, they were larger than SaaS IPOs of yore and, due to base effects, growing slower than their peers that IPO’ed a decade earlier.

A deceleration in revenue growth is expected as the revenue base expands (see our report on The Daunting Math of Growth), and this is exactly what we have seen over the past decade. This relationship is extremely tight: the r2 between median revenue growth rate and median revenue size is about 0.85 over the past decade (meaning about 85% of the variation in revenue growth rate is explained by revenue size). This is true for both the LTSCI and SCI, meaning the inclusion of newer constituents in the SCI does not lessen the relationship.

To some extent the revenue deceleration we are observing is natural and simply a function of size; trees don’t grow to the sky. As such, the fact that revenue growth has decelerated while revenue size has increased does not on its face signal anything problematic. It may simply reflect that public SaaS companies are, on the whole, transitioning to a more mature operating phase.

To some extent the revenue deceleration we are observing is natural and simply a function of size; trees don’t grow to the sky. As such, the fact that revenue growth has decelerated while revenue size has increased does not on its face signal anything problematic. It may simply reflect that public SaaS companies are, on the whole, transitioning to a more mature operating phase.

But It’s Not All a Natural Function of Size

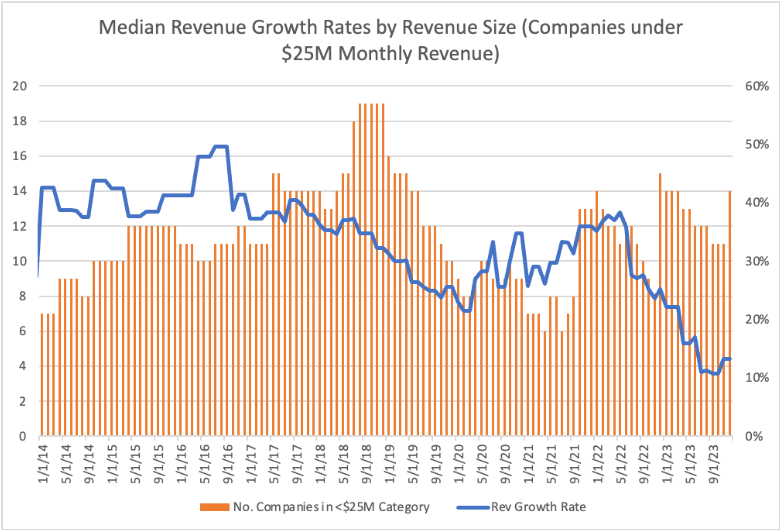

If we separate SCI companies into buckets based on monthly revenue size (sub-$25M, $25-50M, $50-100M, $100-200M, $200-500M and over $500M) we can get a sense of how revenue growth is acting independent of changes in company size.

When we do this, we find that revenue growth rates have decelerated sharply from 2021 local peaks across all revenue size buckets, with the most pronounced decelerations occurring among smaller companies (see below for the most extreme example). With the exception of the 100-200M bucket, all other buckets are either at decade or five+ year lows.

The chart below shows the dramatic drop in median revenue growth among the smallest public SaaS companies.

Based on the above, our conclusion is that other factors are acting to slow revenue growth rates, besides just the increase in revenue base over time.

Based on the above, our conclusion is that other factors are acting to slow revenue growth rates, besides just the increase in revenue base over time.

Possible Factors in SaaS Revenue Growth Slowing

Upcoming research from SaaS Capital will show a quantitative shift to profitability among public SaaS companies. When looking at how increases in profitability have moved across companies segmented into the same monthly revenue size buckets as above, we see that across all revenue size buckets, profitability has inflected higher starting in 2022. And, for the first time in the history of the SaaS Capital Index, changes in valuation multiples exhibit a sustained and strong positive correlation to increases in profit margins.

Put another way, unlike all other times since the beginning of the SaaS business model, the financial markets have started to “encourage” companies to increase their operating income (profit) margins, even at the expense of slowing growth rates. The decelerating revenue growth we are observing may be the result of companies responding to this “encouragement”.

However, it remains an open question as to whether financial markets or SaaS industry dynamics are primarily driving the shift in results.

The fact that we see revenue growth deceleration in smaller-sized companies (where the odds of market saturation are lower) would seem to indicate something changed in the financing world. Since 2022, as growth capital has become more expensive, and exit liquidity more scarce, the attractiveness of incremental revenue vs profit has changed. To this end, it is noteworthy that the deceleration in revenue growth has occurred despite broad economic activity (measured by GDP) holding up quite well. Should revenue growth rates re-accelerate if the cost of capital moves lower, we would get support for this line of reasoning.

On the other hand, these results could mean the industry-wide market for SaaS is saturated and/or that buyers of SaaS are cutting back, and so all SaaS companies are experiencing decelerating revenue growth regardless of company size. There is probably some industry market effect here, but if such a downturn in customer behavior were the primary cause (instead of SaaS vendors adjusting their budgets for profit vs. growth), we would expect to see a decline in profitability as well as growth rates.

Why Public SaaS Metrics Matter

Public SaaS companies provide a reference point and target at which to aim.

Valuation multiples are no longer apples to apples. A 7x ARR multiple now has a different underpinning than the same 7x multiple five years ago. Now you are getting, on average, lower growth but greater profitability. Private SaaS operators need to understand how their company stacks up not just in terms of revenue but also from a profit perspective. And, SaaS investors need to understand this evolution when making comparisons and arriving at an assessment of fair value.

Every company is different, but it is crucial to acknowledge the overall deceleration in revenue growth regardless of company size when crafting your business strategy. Penciling in ongoing robust revenue growth may be more difficult than ever, but for those companies that are able to execute, they will stand apart. Companies raising financing to continue their growth goals will likely need to post lower losses, or even net profits, in order to appear attractive among comparable financing candidates today.

Based on public SaaS comps, an actionable path toward profitability in 2024 and 2025 seems increasingly important and timely regardless of company size.

![]()