Validating Our SaaS Valuation Model: Results from 2024 Market Data

This past week we published a 2024 update to our valuation white paper, “What’s Your SaaS Company Worth?” This paper and its associated data-driven model, revised several times over the past 11 years, are free resources for stakeholders in growing, private B2B SaaS companies. But does this model really work?

We based the model on a statistical analysis of observed arm’s length equity transactions in our private dataset. There are roughly 60 such transactions, in companies averaging $14 million in annual recurring revenue (ARR), used in the latest update. Additionally, we use the then-current public market valuations, as reflected by the SaaS Capital Index™, as a time-sensitive input in order to improve predictive accuracy.

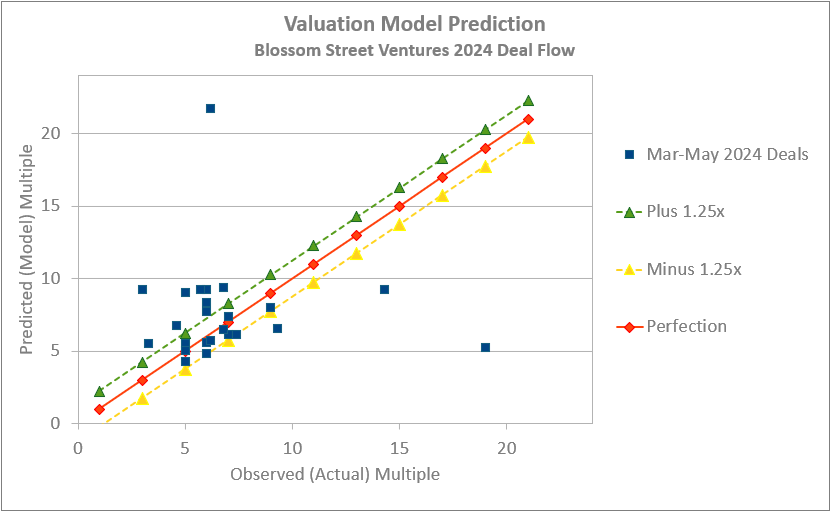

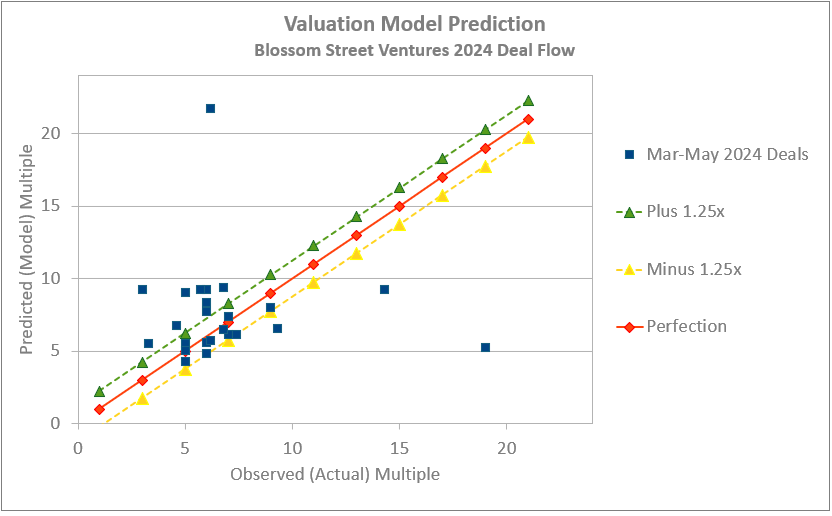

The model performs pretty well within this dataset – but we are always keen to see how it stacks up when run against other, out-of-sample data. Put more simply, does our model work only for our own observed data, or does it perform OK on other real-world companies?

Right as we were typesetting the latest revision of the paper, we got an email update from a SaaS venture investor we have known and respected over the years. Sammy Abdullah at Blossom Street Ventures was opining on current valuations for his kind of deals, namely, “boring [sic] enterprise SaaS with good consistent growth.” (Those ones don’t bore us, either, Sammy!) He shared an anonymized list of deals he saw from March through May 2024, with 27 companies including the ARR, growth rate, and valuation as of a particular date.

With a small simplifying assumption (estimate NRR at a flat 100%), this is enough data to run our valuation model and compare these “in the wild” deals to our model’s prediction. The results were pretty gratifying. A majority of deals were within +/- 1.25x of the predicted ARR multiple. (That’s actually slightly tighter performance than over our long-term internal dataset.)

The outliers are worth mentioning. Mainly, the outliers were sky-high multiples that didn’t seem to align with metrics; for example, 19x ARR for a 35% growth company. That one shouldn’t surprise us, though; that’s a venture investment into a $2 million ARR company, where the valuation could be driven by any number of factors (accelerating growth? FOMO?) other than a strict financial analysis. On the other hand, Sammy also observed a slim 3x multiple for a deal with 100% trailing growth; doubtless, some detrimental factors (slowing growth? team or product distress?) dampened this deal.

The very best valuation outcomes for B2B SaaS are inevitably driven by strategic or competitive factors. Still, for us, this exercise validates the usefulness of our white paper for its intended purpose: deriving a baseline valuation multiple from both:

From that baseline, adjustments up or down are in order, but for a reasonably well-managed B2B SaaS business at steady-state, in a drama-free valuation environment, we think “What’s Your SaaS Business Worth?” gives the best unbiased guidance to a baseline valuation approach.

![]()