The US States with the Biggest Increase in Cyber Attacks

In an age where digital threats loom as large as any traditional crime, the latest IC3 Cyber Crime report serves as a reminder across the United States.

Our analysis uncovers the startling financial toll these invisible threats have inflicted nationwide, revealing the losses that span from the tech-laden valleys of California to the tranquil landscapes of Vermont. As the cyber battleground expands, no state remains unaffected, with the economic impact of cybercrime echoing across bustling metropolises and quiet towns.

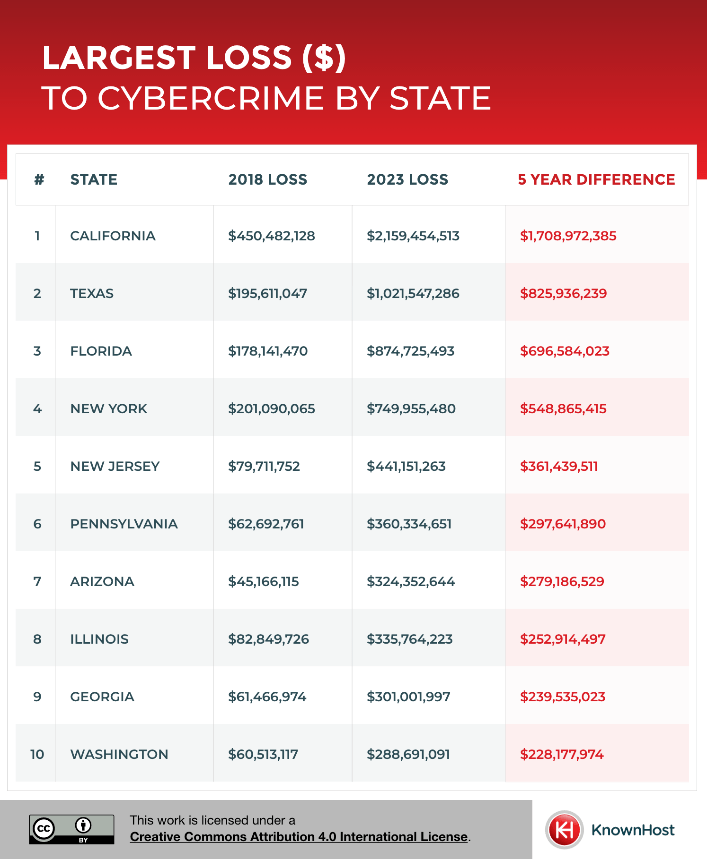

Largest Loss to Cybercrime

California proves the epicenter of cybercrime, with losses surging from $450 million in 2018 to an astonishing $2.15 billion in 2023 – the five year difference ($1.7 billion) not only mirrors the global surge in cybercrime but also places California at the forefront of the invisible battleground. Texas and Florida occupy the following positions, with Texas recording an increase of approximately $826 million and Florida’s losses ballooning by almost $697 million.

Beyond the staggering increases in California, Texas, and Florida, New York stands out with significant financial distress, showing a half-billion dollar increase in losses. This surge is a likely reflection of the state’s dense population and its status as a financial hub, making it a prime target for cybercriminals. Similarly, New Jersey, known for its concentration of corporations and proximity to New York City, has seen substantial financial losses, which speaks to the fact that cybercrime follows the money, targeting areas with rich economic activity.

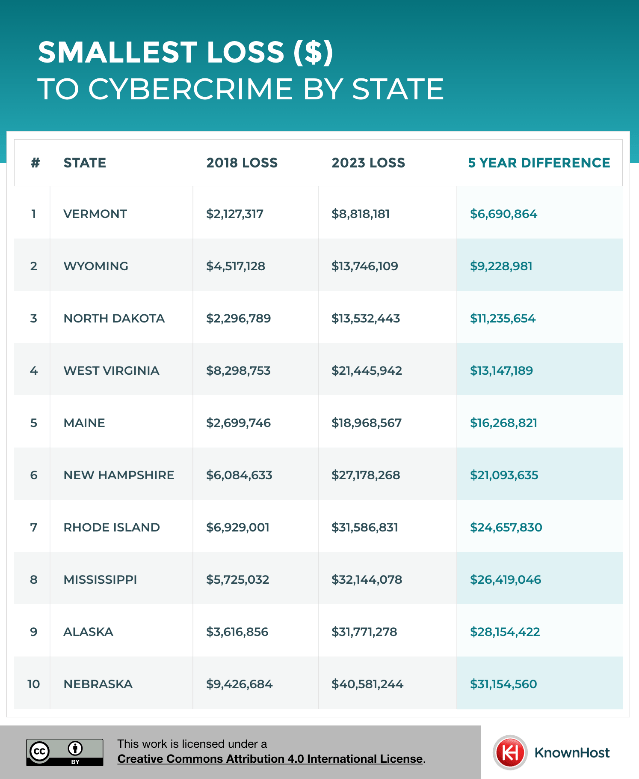

Smallest Loss to Cybercrime

Vermont, while still experiencing a surge in cybercrime, shows a relatively modest increase in losses – rising from $2 million in 2018, to $8 million in 2023.

Wyoming and North Dakota, with their low population density and smaller economies, have experienced smaller overall losses but still face challenges proportionate to their size. These states remind us that cybercrime can be a local issue as much as it is a national concern, with impacts felt deeply by the individuals and businesses targeted.

With that said, some states in this list including Mississippi and Alaska can be considered both remote and less technologically advanced than those shown within the list above.

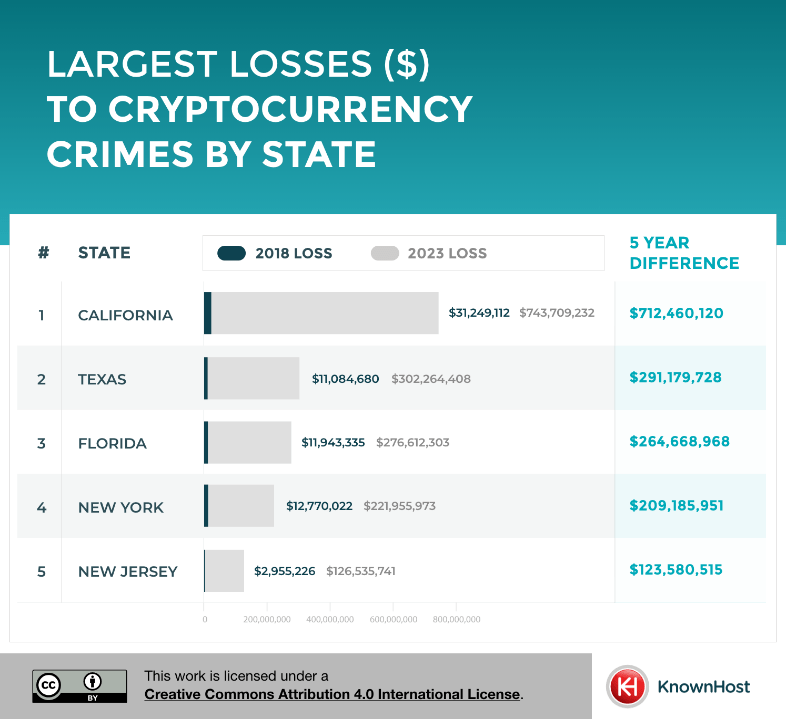

Largest Losses by Crime Type

California, a hub for tech-savvy investors, has witnessed a staggering rise in cryptocurrency crime-related losses amounting to over $712 million. Next up, Texas has emerged as another crypto battlefield, with losses soaring by hundreds of millions of dollars. The state’s growing tech industry and its embracement of digital currencies have made it a prime target for crypto-related fraud.

Florida’s investment community have also been targeted by these schemes, showing that cybercriminals are opportunistic, exploiting the excitement around new investment opportunities.

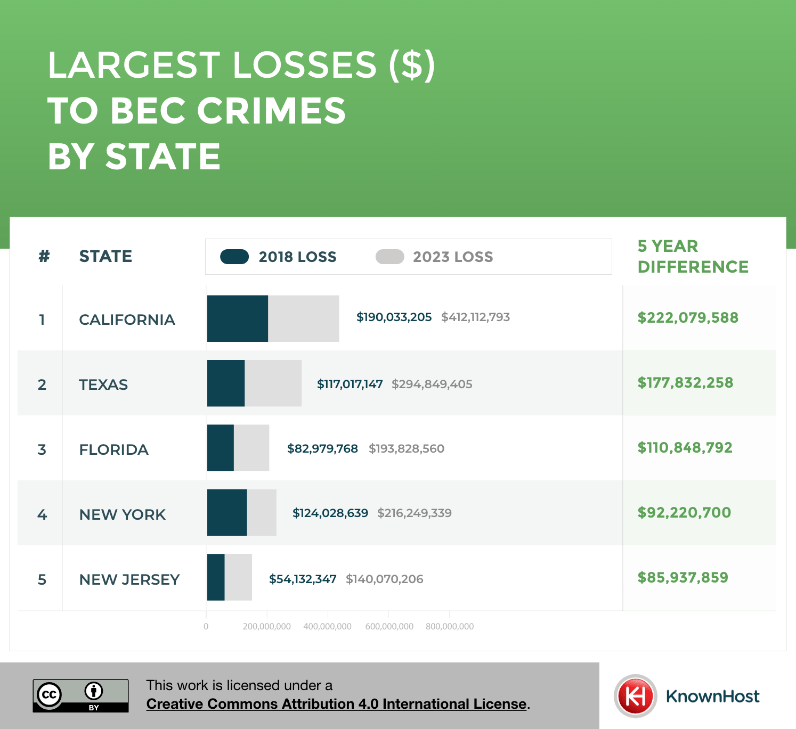

With a combined increase of over half a billion dollars in losses across California, Texas, and Florida, Business Email Compromise (BEC) crimes have laid bare the vulnerabilities within corporate communication networks. These sophisticated scams manipulate email systems or use social engineering tactics to mislead employees into transferring funds or sensitive information.

While California, Texas, and Florida have faced the brunt of these attacks, New York’s finance and business sectors have also been heavily hit, with tens of millions in losses, as sophisticated criminals exploit the interconnectedness of global business.

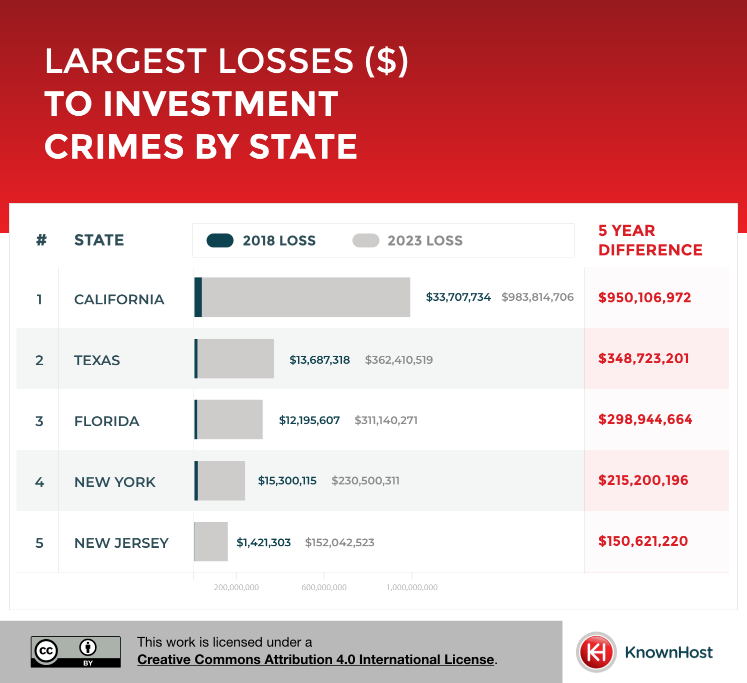

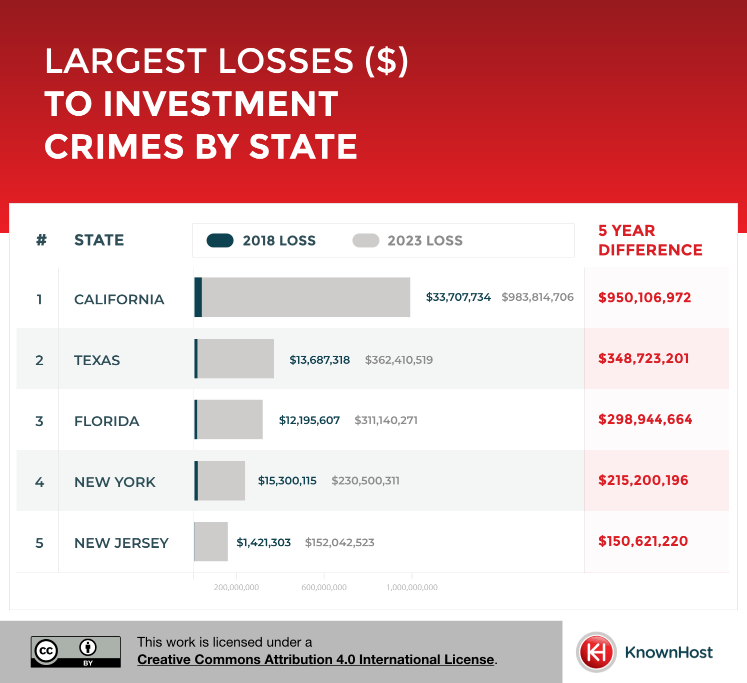

Once again, California’s ripe investment landscape has been hit the hardest by scams, with losses skyrocketing nearly $950 million in five years. This dramatic increase is a stark reminder of the sophisticated tactics employed by cybercriminals to exploit the allure of high returns.

Other states have not been left unscathed. Texas has also felt the sting of these scams, with losses amounting to hundreds of millions. The loss indicates that even the most sophisticated investors can fall prey to the complex web woven by modern swindlers. Florida, too, has seen a dramatic increase in losses to investment scams, revealing that these scams are a widespread issue affecting individuals and institutions regardless of their geographic or economic standing.

Tech Support Crimes present another alarming trend, with California’s losses escalating by over $163 million. This suggests an increased exploitation of the tech-savvy yet trustful populace by cybercriminals.

In states like Arizona, losses to tech support frauds indicate a troubling trend of exploitation across the nation. Arizona, with its significant retiree population, has shown an alarming rise in such scams.

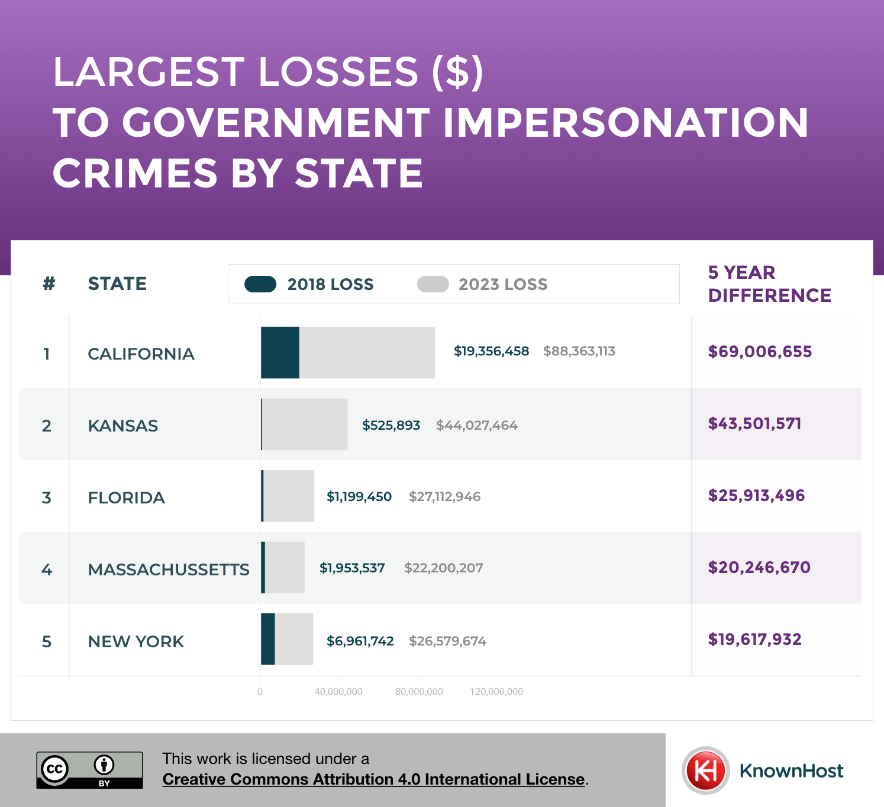

Government Impersonation Crimes in California ($69 million) are followed by Kansas at $43 million. These numbers reveal the audacious attempts by criminals to cloak their deceptions under the guise of authority.

Government impersonation scams, while particularly prevalent in Kansas and California, have also significantly impacted states like Massachusetts and New York. These states, with large urban populations and numerous government interactions, have seen a rise in such scams, with losses totalling in the tens of millions.

Methodology

This research utilizes data from the 2023 IC3 Cyber Crime Report to conduct a comparative analysis of cybercrime losses across U.S. states over the past five years. Methodology steps include:

- Data Compilation: Aggregate the financial losses reported by each state from the 2023 IC3 report.

- Historical Comparison: Compare these figures to those from the 2018 IC3 report to chart the changes and identify trends in cybercrime financial impacts.

- Crime Type Analysis: Break down the losses by specific cybercrime categories for each state using the 2024 data and perform a similar analysis with the 2018 data for a year-over-year comparison.

The primary data source for the current analysis is the 2023 IC3 Cyber Crime Report, with comparative data drawn from the 2018 report. This succinct methodology aims to map the trajectory of cybercrime’s financial damage and discern the most significant threats in each state.

Findings

The comparative analysis uncovers both the growing impact of these crimes and the shift in types of cybercrimes utilised.

Key findings indicate that while certain states like California, Texas, and New York have sustained the brunt of these increases, no state is immune to the virtual threats. The breakdown by crime type further illuminates the evolving tactics of cybercriminals, highlighting the urgent need for enhanced cybersecurity measures and public awareness, cyber defense strategies nationwide.