The Best SaaS Reads of 2022

Every week, I scour the web to pick the top SaaS reads for our weekly newsletter, the SaaS Roundup.

This year alone, I shared over 200 curated reads on leadership, growth, pricing, SaaS metrics, benchmarks, and much more. Here are the best SaaS reads of 2022; those articles and charts that resonated most with 19,000 weekly readers.

Jump straight onto a section using the links below.

Special mention to the teams at OpenView, Bessemer & Battery for appearing multiple times on the list.

Why not subscribe to the SaaS Roundup? Join over 19,000 readers and get the next issue straight to your inbox.

Top 10 SaaS Reads of the Year

1. How Cheap a Product Can You Have And Still Have Salespeople?

– Jason Lemkin, SaaStr

What price point can usually be supported by sales reps? In most cases, a $19/month product can’t be supported by a sales rep but can a $99/month product be? Here is some math.

“OK, so if an SMB rep needs to make say $80-$100k in OTE (base + bonus) … and you need to clear, say, $300k in revenue from that rep to make the math work on your side … at, say, 100 closed deals a year, to bring in $300k to the company, each deal has to have a $3,000 ACV on average”

2. The SaaS Org Chart

– David Sacks, Craft Ventures

You’re the founder of a fast-growing SaaS startup that has just raised funding. Congrats! You now need to hire rapidly to seize the opportunity. But how much should you hire, what roles should you hire, and what should the org chart look like when you’re done?

“Here are some target org charts that a new Series A, Series B, or Series C stage SaaS startup should be staffing towards. Series A Target — 50 Employee Org, Series B Target — 125 Employee Org, Series C Target — 400 Employee Org.”

3. I looked at 105 SaaS Pricing Pages. Here’s What I Learned

– Caya, Slidebean

Slideabean analyzed over 100 pricing pages to understand the various pricing models in SaaS. In the video, Caya goes over the pros and cons of flat, tiered, usage, and user-based pricing models.

“SaaS allows predictable revenue. It lets us estimate customer lifetime value with unprecedented accuracy. These days you can even raise capital or get a loan based on your MRR.”

4. 2022 OpenView SaaS Benchmarks Report

– Curt Townshend, Kyle Poyar, OpenView Partners

OpenView partners shared takeaways from a survey of over 600 SaaS companies. In addition to sharing benchmarks on growth & retention, they share numerous insights on hiring trends, SaaS valuations, & PLG adoption.

“Great CAC payback and great NDR are clear north stars for leveraging optionality, but neither are easy to come by. Smaller companies have shorter buying cycles (lower CAC), but target customers are generally less committed to your product and may be quicker to churn (lower NDR).”

5. Scaling From $1 to $10 Million ARR

– Mary D’Onofrio, Janelle Teng, Ethan Ding, Bessemer Venture Partners

Bessemer VP shares a playbook on how to scale your business from $1 to $10mm ARR. What specifically caught my attention was the detailed data on benchmarks related to retention, growth, acquisition cost, expenses, etc.

“While not deterministic, growth endurance (the rate at which growth is retained from one year to the next) tends to be about 70% in private cloud companies, meaning that you should expect next year’s growth rate to be approximately 70% of the current year.”

6. What I Learned About Pricing From an Entrepreneur Whose Company Sold for $4.75 Billion

– Aaron Dinin, Entrepreneur’s Handbook

Finding the right price for your product offering takes some complex math and solid positioning. Balancing your CAC:LTV ratio and covering how much your software costs to develop are crucial, as are aligning price with the perceived value of your product. Learn more about how Phil Fernadez priced his pioneering software Marketo, which sold to Adobe for $4.75 Billion.

“And so the idea was sort of less specifically what the software would do, but instead, it was this opportunity to democratize the whole category and bring very powerful and sophisticated marketing technology to people that otherwise didn’t have access to such things. And that was really the founding idea.”

7. Your Guide to Product Qualified Leads (PQLs)

– Kyle Poyar, OpenView

According to OpenView’s Product Benchmarks report, only one in four SaaS companies have a PQL strategy, even though PQLs convert at 15-30% and are significantly more valuable than MQLs. If you’re looking to shift to a PQL strategy, or improve your current approach, this article is for you.

“Your ultimate goal should be to engage with the right accounts at the right time with the right message based on what you know about them. Treating PQLs as one-size-fits-all would miss the point.”

8. The Five Must-Have Board Slides for Sales/Revenue Leaders

– Bill Binch, Battery Ventures

Bill Bench has spent the last 15 years of his career attending a lot of quarterly board meetings. In this post, he shares with us five slides that every board meeting deck must have.

“As a wise mentor once told me, no one ever gets a promotion from a board meeting — but people sure do get fired afterwards. Don’t present slides; present the story. Board members are skilled at thin slicing through data and composing their questions ahead of time. Don’t feel the need to present every nuance around your data — get to the point.”

9. The Ultimate Guide to SaaS Pricing Models, Strategies & Psychological Hacks

– Ryan Law, Cobloom

Few things impact revenue as much as your pricing. And yet, the average SaaS startup spends just six hours on its pricing strategy. That’s not six hours a week, or six hours a month, it’s six hours in total. So to simplify SaaS pricing, here is an in-depth guide analyzing the crucial components of SaaS pricing strategy.

“Price is a relative concept, and when we assess the price of something, we use a reference point to work out its value. If we were buying a car, we’d compare its price to the price of other cars on the lot.”

10. Battery’s Cloud Quarterly – Founders Almanac

– Neeraj Agrawal, Brandon Gleklen, Battery Ventures

Full of data insights, this 42-slide deck from Battery Ventures is a must-read. They go into details around i) ARR per employee benchmarks, ii) Public cloud valuations, iii) Rule of 40, iv) State of SaaS funding, and much more…

“ARR per employee is a great efficiency metric to rally a company around, as growth efficiency metrics (eg. CAC Payback and magic number) can feel less tangible for employees outside the go-to-market organization.”

Top 5 ChartMogul Reads

1. What Is a Good Monthly Growth Rate for SaaS Startups?

– Thomas Anastaselos

Did you ever wonder how your growth compares against your peers? We analyzed and aggregated data from ChartMogul to find out what a good growth rate for SaaS startups truly is.

“In the very early days (<$10k MRR), a SaaS startup grows on average by 4.4% every month. That’s 68.0% annualized. As it continues its march towards the $50k MRR mark, it grows at 3.1% every month or 44.9% annualized. Over time, as the company reaches a sizable revenue, growth slows down a bit but remains well over 2% per month.”

2. What Is a Good Customer Churn Rate?

– Sid Jain

What according to you is a good customer churn rate? Worry not, we’ve got the answer. We number-crunched data from over 2,300 SaaS businesses to find out.

“The best companies should target a customer churn rate of <2% per month. This goes down to <1% as your ARPA increases.”

3. How a Pricing Migration Enabled ChartMogul To Retain the Right Type of Customers

– Ingmar Zahorsky, Bianca Wilk

Our VP of Customer Success shares his takeaways from the pricing migration that started in 2018. ChartMogul lost a large number of legacy customers when migrating them to a new pricing model, however, the highly engaged `good fit` customers enabled ChartMogul’s continued growth.

“In that customer segment, we lost 178 accounts. From 322 subscribers in September 2018, we went to 144 in February 2020. Account retention was 44.7%. However, looking at MRR in that same segment tells a different story. We went from $57,640 to $85,838 and attained almost 148.9% MRR retention.”

4. SaaS Benchmarks Report

– Sid JainThis year, we released our first-ever ChartMogul SaaS Benchmarks Report. In this report, we analyze, anonymized and aggregated data from thousands of SaaS businesses to bring you benchmarks for early-stage SaaS companies.

“Companies with a higher average revenue per account (ARPA) tend to grow 1.5-2x faster. A higher ARPA corresponds to a lower customer churn rate.”

5. SaaS Metrics Every Startup Founder Should Know

– Andrew Gazdecki

You don’t know how your business is doing if you’re not measuring its performance. The best way to keep track of your growth is to monitor your SaaS metrics.

“The customer engagement score is an overview of your customers’ level of engagement. You can create your own engagement score with inputs based on the activity and usage of your product or service. For example, a customer who’s using your product daily for more than an hour has a higher customer engagement score than someone who’s only using your product once a month.”

Top 5 Charts of the Year

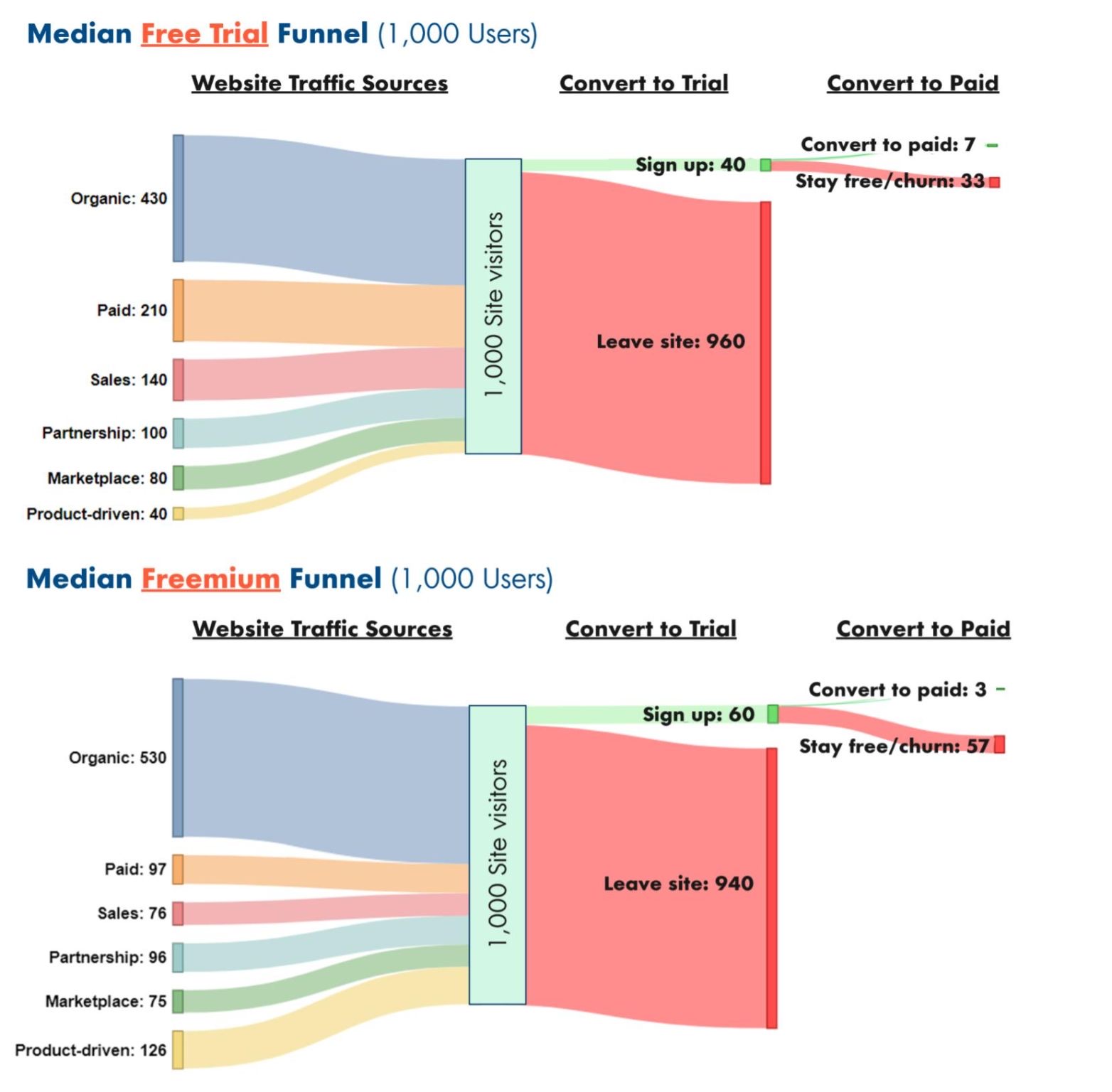

1. What’s the Average Conversion Rate for SaaS Businesses?

Only 0.7% of visitors to your website convert to paid. That number is just 0.3% if you offer a freemium product.

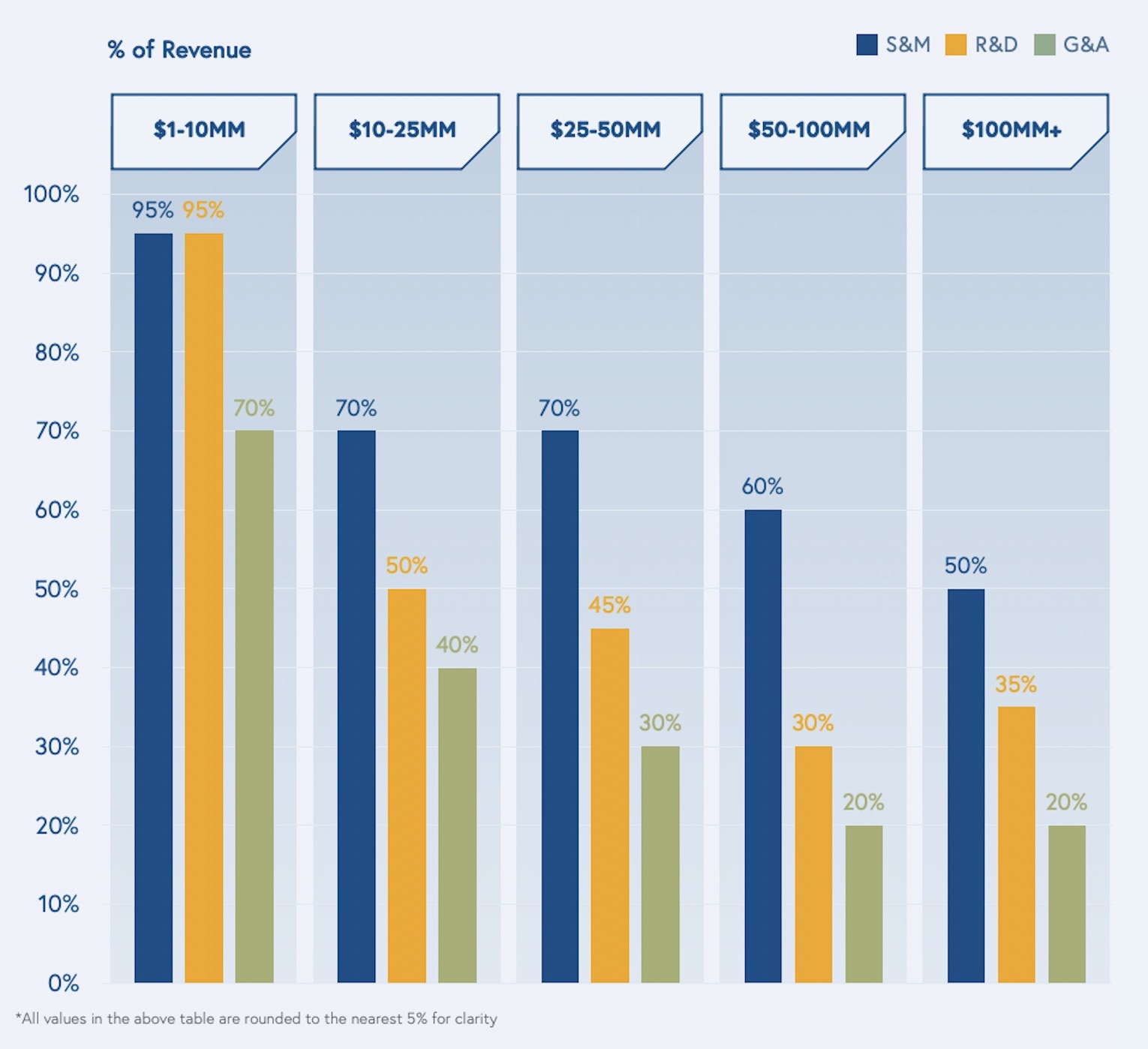

2. What’s the Major Expense Line Item for Most Venture-Backed SaaS Businesses?

Engineering? No, it’s sales & marketing (S&M). The chart below shows the margin structure by ARR range for venture-backed SaaS companies. Marketing & sales make up for the largest share of spending, making up for almost ~95% of revenue for companies with ARR <$10m. As companies grow and reach scale (>$100m ARR), S&M expense still makes up for ~50% of revenue.

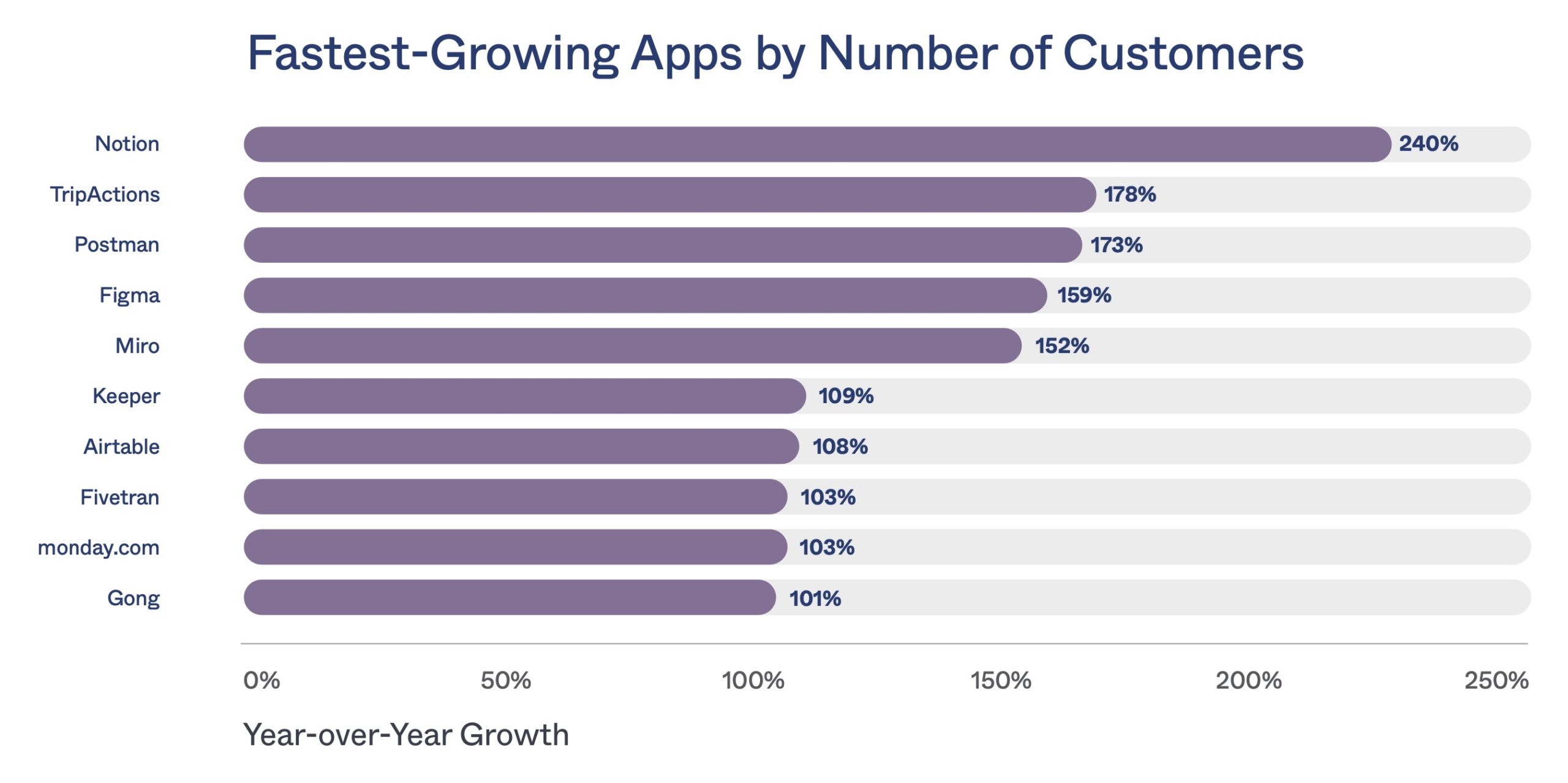

3. What Were the Fastest Growing Apps at the Workplace in 2021?

Notion was the fastest-growing work app last year, followed by TripActions (expense & spend management) & Postman (API building platform). 5 of the top 10 fastest-growing work apps (Notion, Figma, Miro, Airtable & Monday.com) were built with team collaboration in mind.

4. What’s a Good CAC Payback Period?

It depends on the market you sell to. Companies selling to consumers/SMB segment have shorter buying cycles/lower CACs compared to those selling to enterprise customers.

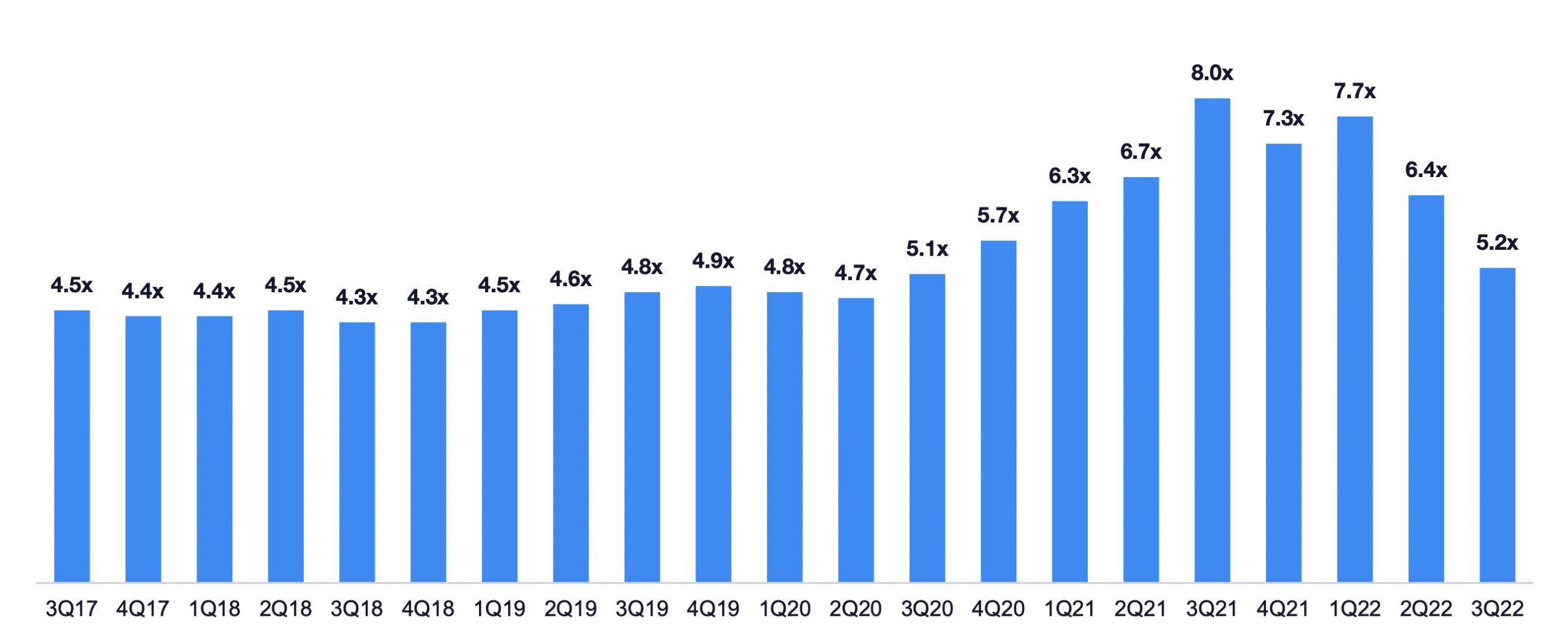

5. What’s a Good Exit (M&A) Multiple in SaaS?

Last quarter, SaaS companies were acquired at a median M&A exit multiple of 5.2x times EV/Revenue (trailing 12 months). This has come down from the highs of 2021 (down 35% YoY) but is still 10-15% ahead of pre-pandemic levels.

Happy Reading!

Thank you so much for being a part of the SaaS Roundup this year. If you have any suggestions at all for the newsletter, reach out.

Join over 19,000 readers who get the SaaS Roundup straight to their inbox each week.