SaaS Capital AI Update for 2025 Q1

Previously, we put forth an opinionated and (we hope) practical framework for thinking about AI for the B2B SaaS company operator.

While we largely stand behind those ideas, two key inputs recently have made us update our thinking in important ways: the latest SaaS capital survey results on AI, and a personal epiphany from using AI for a hobby development project.

SaaS Capital Annual Survey Responses on AI

Each February our annual survey of private B2B SaaS companies attracts around a thousand responses. Respondents are typically CEOs, CFOs, or key execs. For 2025, we added a few questions about how companies are actually using AI.

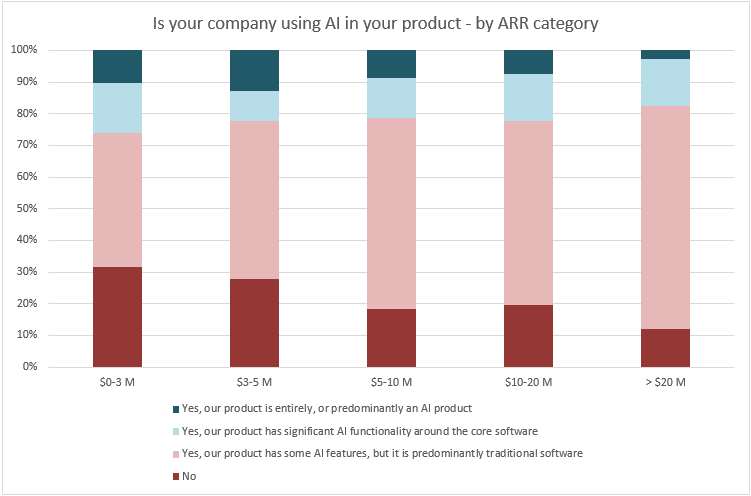

There was a striking result in AI usage based on the size of the company. Small (< $3M Annual Recurring Revenue) and bigger (> $20M ARR) companies are approaching AI very differently, in a “barbell” effect where smaller companies have a more extreme approach.

The Smallest Saas Companies Are Most Likely to be Either all-in on AI or Completely Reject It

Small SaaS companies under $3M ARR are far more likely than bigger ones to outright disclaim using any AI in their product (32% vs. 12% said “None”). But, they were also far more likely to be “AI-only” or “AI-first” (26% vs. 18%).

By comparison, the larger SaaS companies in our sample were more in the middle: very few of the $20M+ ARR companies totally rejected AI in their product, and almost none considered themselves “AI-first.”

The “AI-first” difference among size tiers is probably because AI-first or “pure plays” are all relatively new, and haven’t grown to over $20M in ARR yet. And the “No AI” concentration among the smallest SaaS companies might be healthy for them if it means that those companies are first figuring out their value prop and GTM before trying to augment with AI.

A Personal Experience With AI Copilot for Software Development

We continue to believe that for general-purpose human consumption, AI’s generative output will continue to be mostly “slop” – maybe better than nothing, but unlikely better than a good human.

However, the more specific purpose you aim for, and the more formalized the output, the more likely AI is to outperform. I was recently shocked at this quantum leap of quality of output while using AI in a “copilot” mode for a small software development project.

An Outdated Coder (Me) Gets an Instant 5x-10x Upgrade

I recently (early 2025) took an afternoon to test out an AI “copilot” (Cursor) for a hobby project of sorting through some old audio files. For context, I had written Python before but hadn’t started a new coding project since 2014.

After about two hours of sometimes puzzling, sometimes elating, mostly playful use of this copilot, I had a prototype with a couple thousand lines of code that could sort through audio files and cluster them together by similarity, graphing the results visually.

- Without AI, this could have been an outcome of two hours from a machine-learning practitioner or data scientist, starting from scratch.

- Without AI, this would have taken ten or more hours for me, with a minimum of two hours of reading API documentation alone.

- I suspect if I were a proficient user of copilot technology, the prototype might have taken 20 minutes instead of two hours.

- The output from the AI was not perfect, but it was clean and followed basic “style guide” conventions.

- A human racing to write code could not have attended so carefully to detail.

Why is Coding with AI Importantly Different from E.G. Writing Marketing Copy?

Why was the output of AI in coding so much better than the “slop” output to a general-purpose inquiry to an LLM?

But crucially – this type of workmanlike, engineering-not-science coding is the bedrock of the B2B SaaS industry. Few SaaS companies get their competitive advantage from true innovation in their code – the kind of thing that you could patent or only a few Ph.D.s could understand.

Rather, even a technically complex SaaS product is composed of well-known technologies, with a fair amount of “glue” code to hold it in a particular way that fits their value proposition. AI copilots, with competent direction, will excel at this kind of assemblage.

A Fraught Conclusion For Small SaaS

Single feature point solutions are at extreme risk as going concerns (but are ripe opportunities for tiny teams).

A simple prototype or “toy” version of a SaaS point solution rarely poses a threat to incumbents, because of the Pareto principle where the “final 20%” that turns a toy into production ends up taking 80% of the time.(Think: billing, permissions / access control, sharing / collaboration, backup / redundancy … etc.)

But spending 80% of your time on the final 20% hardly matters when you’re consistently working 5x-25x as fast. A truly skilled user of copilot-type coding probably has the effectiveness of a 10-person product team.

A CTO or VPE level individual, backed by AI copilot(s), can have code built to spec as fast as it can be spec’ed. That code also now almost effortlessly comes with ancillary things (logging, testing, etc.) that get short shrift in a “toy” or prototype version.

The new face of the $1M ARR SaaS company is a one-person operation led by either a technically-oriented product marketer, or a marketing-savvy technologist.

The Race to $10M ARR, Now with Different Prizes

The survey results chart and the observations above should worry any highly focused $0-5M ARR company. If their value proposition can be cloned by a tiny team using AI as a development turbocharger, then they may not have enough “gravity” in the marketplace to fend off an AI-copilot-developed new entrant.

(Of course, there will be AI-free $0-5M SaaS companies for which none of this matters. Holders of truly “hard” IP or scarce connectivity/exclusivity agreements, and niche systems of record, for example. But don’t live in denial and talk yourself into thinking your small SaaS company must be an exception: this is a dangerous zone!)

Furthermore, this all could happen extremely rapidly. What might have been a months-long development effort to get a “minimum viable product” in market might now be days or weeks. A narrow point solution or an underdeveloped platform with a primary “thin entering wedge” for value proposition is now even more vulnerable than in pre-AI times, until it reaches enough scale and gravity to fend off new entrants.

It’s been a “race to $10M ARR” for years now, as a somewhat “magic” number leading to an option of sustainability or exit opportunities. But the competitive landscape now seems less like $10M is a finish line you can cross at your relative leisure, growing either faster or slower as the case may be. Today’s race to scale for small SaaS might be a modified “Glengarry Glen Ross” contest: first prize, a Cadillac … second prize, a fight among subscale new entrants with a set of steak knives.

Two Metrics to Watch and a Metric Prediction

But the staying power of a small SaaS company isn’t just about ARR. It’s probably more important to focus on two other metrics: ACV, and “k”.

Annual Contract Value isn’t on its own a savior, but if you can get your customers to pay more for your solution, it’s a good proxy for how valuable they find it. A “point” solution supporting a lower ACV is at greater risk of AI-turbocharged disruption than one with a more considered purchase, integration, and training costs, and institutional momentum that tends to come with a higher ACV.

The metric “k” is borrowed from B2C, where it’s used to measure viral growth. It means the number of new users brought in by each existing user per unit of time. The actual value of “k” here is not crucial, but companies who track a nonzero k have a network effect which is protective against new entrants. Outside of Product-Led Growth companies (which in B2B are more the exception than the rule), we rarely see “k” or network effects explicitly discussed in B2B SaaS. Perhaps this needs to change.

Finally, we predict that the personnel cost for software developers will significantly rise, and the number of developers on staff will fall, among the most successful small SaaS companies. The old playbook of finding (and managing) lots of low-cost outsourced developers will become obsolete: the new playbook will be to have a much smaller, well-equipped, AI-augmented team.

![]()