Interest Rates: More to Know Than Just the Headline Number

Interest rates are the bedrock of the financial world. However, equities tend to garner far more attention. One of the drawbacks of this is, for many, analysis of interest rates often stops at the headline level. The result can be an incomplete understanding of credit market dynamics, the cost of borrowing for different borrowers, and the market’s perception of risk.

Currently, benchmark interest rates (US Treasury rates) remain elevated, but what does this actually mean for private SaaS companies looking to borrow? Here we take a look at where corporate rates are for public companies in the US Information and Technology sector (which includes public SaaS companies) to develop a more complete assessment of where rates stand today. These figures may not match exactly what a private SaaS company can expect to see in the market, but they are directionally revealing, as any changes in the public market are likely to filter into the private credit market.

Our key takeaways are presented below:

- Rates for high-yield public corporate borrowers in the Information and Technology sector have averaged around 15% over the past 2 years. Given this, mid-to-high-teen rates for private, growth-stage SaaS companies do not appear out of line.

- After rising steeply from their COVID-era lows, rates for high-yield corporate borrowers have retraced a large portion of their advance, unlike US Treasuries which are hovering much closer to their post-COVID highs.

- The result is that credit spreads – the difference between the rate paid by corporate borrowers and that paid on US Treasuries – are very tight. Said differently, markets are pricing in multi-year lows in credit risk for these borrowers.

- In all, while private rates in the mid-to-high teens remain elevated compared to the past decade-plus, they are in line with rates for sector peers in the public market. Moreover, from a borrower’s perspective, these rates may actually be considered relatively attractive when one accounts for current US Treasury rates. If the market moves to discount higher credit risk, overall rates could push higher for this segment of the market.

A look at Corporate Rates in the Technology Space

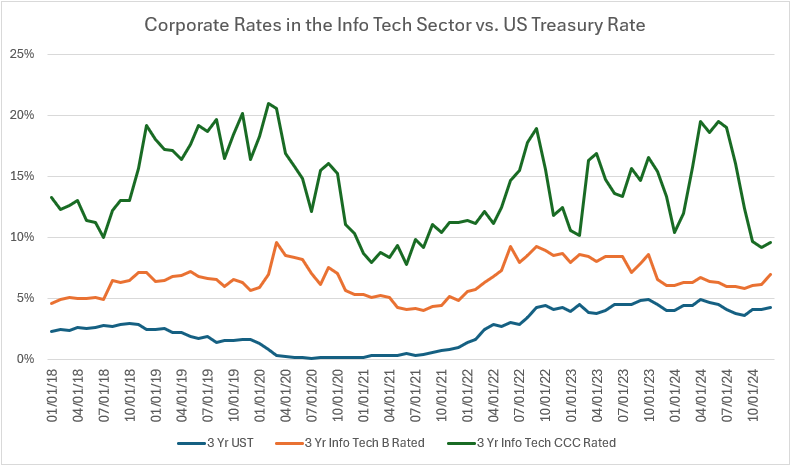

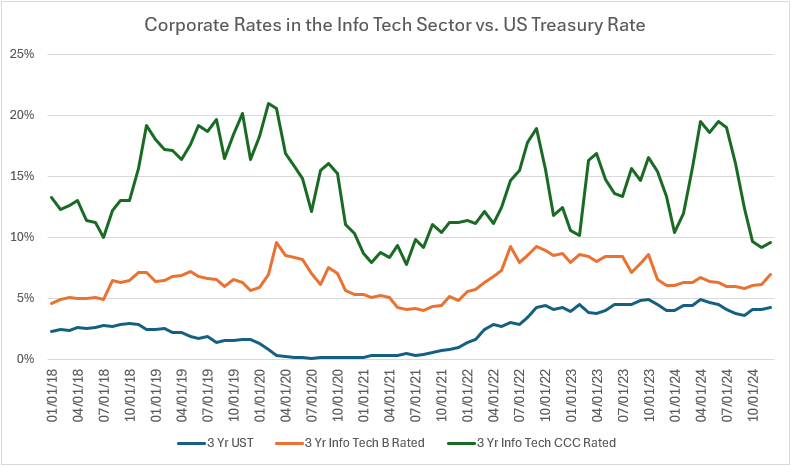

The chart below presents the yield on three-year US Treasuries as well as the yield on three-year B and CCC rated credit in the US Information and Technology sector.* We selected the B and CCC rated segments for analysis as their yield and typical characteristics are most closely aligned with those of a growth-stage, private B2B SaaS company.

Source: Capital IQ

As one can see from the blue line above, 3-year Treasury rates have risen materially from their COVID-era nadir and as of year-end 2024 are hovering around their highs. However, the story is different for corporate rates in the Information and Technology sector. While rates for both B and CCC rated borrowers increased significantly from their 2021 lows, they have since reversed a meaningful amount of this and are currently at or below their average levels of the past 6 years. Yields for CCC rated borrowers in particular have fallen sharply in the past 6 months and are now only slightly above their COVID-era lows.

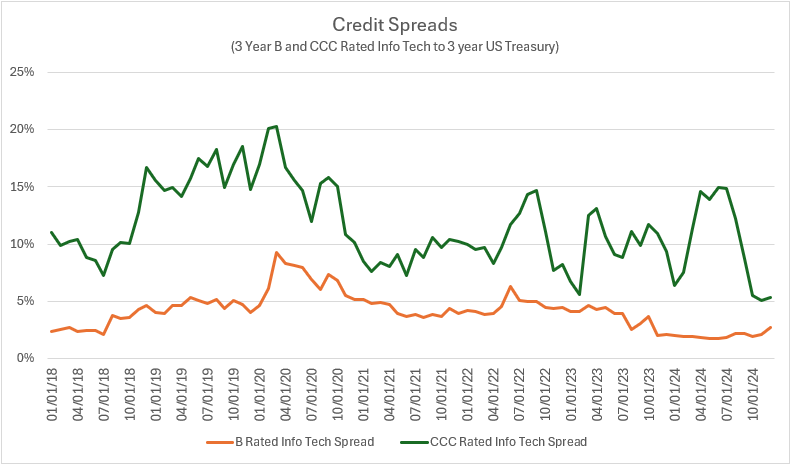

This can be seen most clearly by looking at credit spreads. For corporate borrowers, the overall headline rate can be decomposed into two segments: the “risk-free” rate (typically measured using a US Treasury) and the credit spread, which is the difference between the headline rate at which a corporation can borrow and the risk-free rate of the same duration. One can think of the spread as a measure of the incremental return required by a lender to lend to a riskier business than the US government. The table below shows the credit spreads for B and CCC rated borrowers in the Information and Technology sector (this is the delta, or difference, between the orange and green lines and the blue line in the chart above, respectively).

Credit spreads for both ratings are at or near 6-year lows. In other words, the market is asking, and companies are paying, the lowest risk premium in 6 years to borrow. From an allocator’s vantage point, there is little margin of safety priced into corporate spreads relative to recent history. This may prove to be correct, we certainly don’t know how the future will unfold, but the point is that credit spreads currently are not baking in much margin for error should corporate credit risk prove to be greater than presently priced.

From a borrower’s perspective, the 6-year low in spreads gives important context to the overall level of rates. Borrowers are currently paying the least amount of premium in six years to borrow compared to US Treasuries. Should credit spreads return to their 6-year average, B and CCC borrowers would be paying 2-5 percentage points more to borrow, all else being equal.

Interest rates on US Treasuries remain near their highest levels since the Global Financial Crisis. As a result, absolute rates for SaaS companies are higher than they were during the previous decade-plus. We do not expect this to change in the near term. Nevertheless, we believe that current credit spreads may offer a relatively attractive opportunity for companies looking to raise debt. Operators cannot do anything about the overall level of Treasury rates, but they can take advantage of low premiums to borrow relative to Treasuries.

* Credit ratings are a measure of the “riskiness” of a business. They range from AAA (perceived to be the least risky) down to C. B and CCC rated borrowers are considered high-risk (aka high yield) credits and vulnerable to default. We use companies with these ratings as proxies for smaller, earlier-stage, private SaaS companies. Note that there can be a significant difference in market attitude between B to CCC, despite their proximity in terms of rating.

![]()