Exploring the Cost of Capital for SaaS Companies – Part III: Cost of Equity Simplified?

In Parts I and II, we looked at public company data and private company valuation models (backed by data) in order to come up with some empirical guesses for the cost of equity capital for SaaS companies. In this part, we step back from the data for a moment in order to examine the theory. The result may surprise you.

ARR growth rate is equal to the cost of capital (sometimes)

Here’s the surprising conclusion: for a steadily growing SaaS company, with stable and typical SaaS metrics, paying no dividends, and over a time period where there is no expectation of macroeconomic changes, the cost of equity and the ARR growth rate are the same:

Ke = g

It doesn’t matter for this purpose what the valuation multiple is for a company, only that the valuation multiple is not expected to change over time. In an ARR-multiple valuation model, If the expected multiple is held constant, an equity investor’s expected gain must be exactly proportional to the change in ARR – that is, the equity return rate is the ARR growth rate.

It also doesn’t need to be the case that we “expect no changes” to economic conditions. It only needs to be true that there is no specific expectation of a change one way or another.

Below I’ll describe what assumptions go into this idea, how to sanity-check the result, and describe some of the situations that complicate or invalidate this idea.

Simplifying assumptions (that the industry runs on)

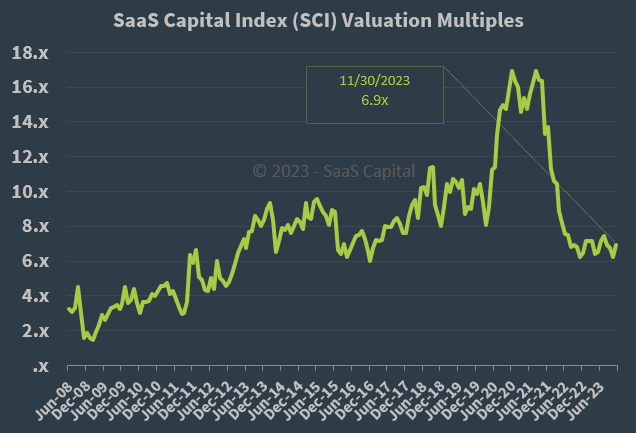

The entire SaaS industry has a rough consensus that the way to value SaaS businesses is on a multiple of revenue – the broad market appetite for owning SaaS. That’s why the SCI is such a compelling idea: the median SCI multiple. publicly quoted valuation metrics can help guide, at least directionally, private SaaS deals.

However, the median SCI ARR multiple doesn’t “tend to go up” year after year: because it’s a ratio and not an amount, it could stay exactly the same even if the SaaS industry as a whole is incredibly successful. The median ARR multiple is as likely to go up as to go down at any moment, all else equal. (If you know what direction it’s headed – quick, call your stock broker and make a fortune.)

Figure: the SCI is a ratio, not a quantity.

Growth is king in more ways than one

We often repeat that growth is key in SaaS valuations. Our “What’s Your SaaS Company Worth” valuation white paper uses ARR growth as the most important factor (Net Revenue Retention can usually be left out). The other big factor is the SCI multiple – but we’ve established above that we don’t have any valid expectation about what direction the multiple will be moving in future.

Consider buying one share of a SaaS company (constant growth, no dividends) on January 1, 2099, and selling it on January 1, 2100. What return could you expect? If our valuation model holds true at both dates, and if there was no valid reason to expect a change up or down in the SCI multiple, the change in share price is expected to equal the growth rate. And, as we discussed in Part I, the return to equity must equal the cost of equity.

Therefore, the simplified conclusion is:

Return to equity = Cost of equity = ARR growth rate.

Or,

Re = Ke = g

Call an ambulance for the business school profs

We realize that certain professorial types, or certain experts whose reports rely on baffling juries and auditors with math, may be offended. There’s no correction for taxation! (Most private SaaS companies have accumulated net operating losses.) There’s no debt-to-equity ratio! (We are assuming a debt-free company.) There’s no dividend cash flow! (Again, private SaaS companies rarely pay dividends.) Where’s the risk-free rate and the Greek letters? (Those things might change, but we have no expectation that they will.)

But hear us out: if SaaS companies, unlike in most other industries, have predictable valuations, based only on their ARR, because of predictable unit economics and predictable business models, then what’s so strange about the idea that their cost of equity might also be validly modeled in a simple fashion?

Limitations of this approach

Using growth as a proxy for the cost of equity is inherently oversimplified. The biggest assumption is that the growth rate will not change. In practice, most companies’ growth rates slow as they grow (paradoxically, equity investors usually claim that their investment will accelerate growth).

Another related assumption is that there is no valid expectation of a change in valuation multiple. This is true in the abstract, but because of mean-reversion, it should be possible to identify extreme conditions that are likely, eventually, to moderate. There’s also good historical evidence that public multiples below 6x or above 12x will fall back into that more normal range.

Obviously, a negative growth rate doesn’t necessarily mean a company has negative or zero value. (Although sometimes, that can be the case.) So we should expect Ke = g to stop holding true as g descends to << 10%. And, growth rates that are manifestly unsustainable will not be sustained, so we would expect g >> 100% to be an unreliable estimator as well.

Putting estimates into practice and action

In our final Part IV, we give our recommendation on how to use these different approaches to get a practical estimate for the cost of equity – and what to do with that information as you choose how to finance, sell, or buy your SaaS business.

![]()