Comparing Revenue Growth Trends in the Public and Private SaaS Sectors

Median revenue growth rates have been decelerating steadily for public SaaS companies over much of the past decade. The deceleration was temporarily reversed during 2021 on the back of government support policies, rock bottom interest rates, and work-from-home pulling demand for digital services forward; however, it has since reasserted itself.

This is the case whether we look at the median revenue growth rate across the SaaS Capital Index™ (SCI) or we segment public SaaS companies by Annual Recurring Revenue (ARR) size (segmenting by ARR allows us to control for the effect that revenue growth rates tend to naturally slow down as the overall size of revenues grow).

Public SaaS revenue growth rates are hovering around 10-year lows. At the same time, operating margins among public SaaS companies have improved materially, especially since 2022, and the median company is now approaching breakeven. [See our recent research: Why Long-Term SaaS Revenue Growth Rates are Slowing; and What it Means for Your Private B2B SaaS Company].

What is driving this ongoing deceleration in revenue growth and recent shift toward profitability is up for debate. It could be the outcome of tighter financing conditions for companies, which causes them to raise funds “internally” by becoming profitable or it could be a fundamental shift in the SaaS market or broader economy.

SaaS Capital recently completed our annual survey of private, B2B SaaS companies. With the most recent data in hand, we thought it timely to look at revenue growth rates for private SaaS companies and examine whether any of the above trends identified in public companies are also present in the private sphere.

Private SaaS Growth Rates have Outperformed

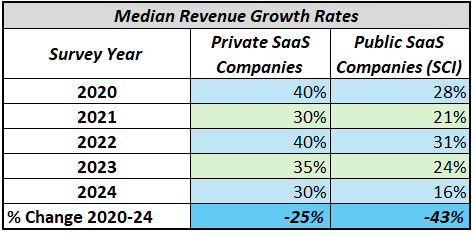

Based on our recent survey, the median private SaaS company had an annual revenue growth rate of 30%, nearly twice the rate of the median company in the SCI (16%). This result is not surprising, as the typical private SaaS company is much smaller (in terms of ARR) than its public sector counterpart, and all else equal, it is easier to achieve higher growth rates from smaller revenue bases.

A more revealing comparison is looking at how private sector revenue growth rates in the latest survey compare to their recent history. When we do this, we can see that the universe of private sector SaaS companies, while not immune to the broad deceleration in revenue growth, has delivered relatively more resilient growth rates than their public sector counterparts.

Median growth rates for public companies roughly halved from the 2022 survey year highs to current levels and are currently 43% below their 2020 survey year levels (survey year data captures the prior calendar year growth rates). Growth rates for private companies also have clearly moderated from their 2022 highs as well as their 2020, pre-covid, levels; however, the -25% decline in growth rates is less severe.

There is no doubt that private SaaS company growth rates have slowed materially – the median growth rate is now equal to the local low seen in calendar year 2020, the peak of COVID-era disruption. But this performance looks far more impressive when we consider that the median growth rate in the SCI is nearly a quarter lower than its calendar year 2020 level. The sharp annual deceleration in SCI median growth rate in the latest survey is particularly striking – declining from 24% to 16% – when compared to the much more modest deceleration in private SaaS median growth rate from 35% to 30%.

Overall, growth rates have decelerated across the board, but the median growth rate in the private SaaS company universe has significantly outperformed, on a relative basis, that of the SCI.

What might be driving this divergence in growth rates?

While we cannot pretend to be certain of the underlying drivers responsible for this divergence between public and private SaaS companies, below we highlight some factors that may be contributing to this outcome.

- One potential factor influencing the relative outperformance of private SaaS company growth rates against their public sector counterparts is that smaller-scale companies may still have a lot of overhead room into which to grow, unlike larger operators whose market size and growth may be more sensitive to GDP and macroeconomic factors.

- A second potential driver may be that the universe of private companies has not undergone the same relative shift toward profitability over revenue growth that we have witnessed among SCI constituents. Anecdotally, we have heard an increased emphasis on reaching breakeven among private SaaS companies; however, based on our recently completed survey, the majority of private SaaS respondents indicated they were more focused on revenue growth than expense management in 2023 and, broadly, expect to continue this approach in 2024. This is corroborated by the finding that the same percentage of respondents (52%) reported operating at a loss in the 2024 survey as the prior year’s survey.

- Finally, there is a meaningful percentage of bootstrapped companies among the respondents to our survey. Such companies would likely be less sensitive to changes in financing conditions, which would allow them to pursue their growth plans largely unimpacted by the sharp rise in interest rates over the past two years.

Regardless of the specific confluence of factors responsible, in a world of broadly decelerating growth rates, so far, private SaaS companies have been the relative winners.

![]()