Private B2B SaaS Company Growth and Profitability Update: Q3 2023

In November 2023, SaaS Capital launched a short survey to compare intra-year data against our long-running annual B2B private SaaS company metrics survey. We focused on just two areas: growth rates and profitability.

The key takeaways from the results are:

- Growth rates have slowed considerably through 2023.

- More companies, as a proportion of the total, are shrinking than we’ve ever seen.

- Companies have responded by cutting costs – most are profitable or close to it.

- Growth rate + Profitability Ratio (aka GP Ratio or “Rule of 40” number) has increased for most companies through 2023 – their profitability has increased more than their growth rate has declined.

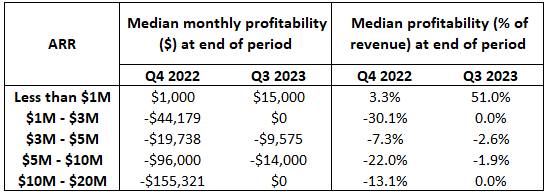

The table below shows annualized median growth rates grouped by ARR ranges at the end of 2022 and the end of Q3 2023.

Slowing Growth Rates

Growth rates have declined significantly in 2023 from where they were at the end of 2022. Median growth rates in 2022 were 30% to 50% depending on company size, but by Q3 2023 growth rates have dropped to 20% to 27.5% for companies with at least $1 million in ARR.Also, this updated data shows that 12% of respondents are currently shrinking, compared to only 3.1% at the end of 2022.

The Q3 2023 annualized growth rates are more in-line with 2020 growth rates, when the world slowed way down in the heart of the COVID-19 pandemic. Growth rates in 2022 across all annual recurring revenue (ARR) levels were in-line with pre-pandemic 2019 growth rates, so we’re surprised to see such a decrease over the first three quarters of 2023.

Looking back, Q1 was relatively “post-COVID normal”, albeit the Fed had begun raising rates and the specter of a recession appeared. Anecdotally we know numerous companies completed reductions-in-force (RIFs) at the end of 2022 and in Q1.

The second quarter featured the collapses of Silicon Valley Bank, Signature Bank, and First Republic Bank and sent a shock wave through the technology and financial services industries. Companies spent Q2 working internally, ensuring access to their cash and understanding the ramifications to their venture debt. It was tough to be focused on growth in Q2.

However, Q3 2023 recorded a blockbuster GDP figure of 5.2% annualized growth, and the broader economic data available to-date into the fourth quarter look very positive. We look forward to our regular, full survey in January on 2023 data to see how the full year finishes out.

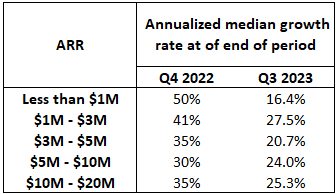

Profitability Climbing

Like their public counterparts that we track in the SaaS Capital Index, private B2B SaaS companies have responded to slowing revenue growth by cutting costs.

The chart below shows median monthly profitability both in absolute dollars and as a percent of revenue.

Companies with less than $1 million in ARR are noisy due to their small denominator, but there is a clear signal from the larger companies: companies on median burned 20% of revenue in 2022 but by the end of Q3 2023 almost all have reached breakeven.

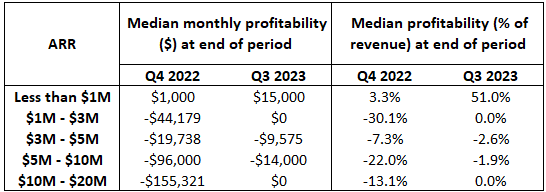

GP Ratio Also Increasing

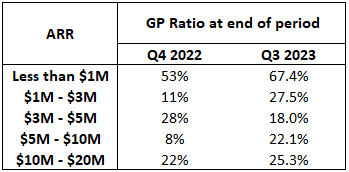

Interestingly, the median GP Ratio (growth rate plus profitability percentage, also known as the Rule of 40), has increased through the first three quarters of 2023. The chart below shows the median GP Ratio by ARR grouping.

Knowing that growth rates are generally slowing, this chart shows us that companies have increased profitability by more than their growth rates declined. This is a very important point. When equity valuations were much higher (2020-2021) and getting investment cash was cheaper, it perhaps made sense to burn 60% of revenue to grow 40-60% per year (a negative GP Ratio is never good, but more companies have one than you might think), but if growth slows to 20%, and equity dollars are 3x more expensive than two year ago, that position is no longer defensible.

As a comparison, as of November 30, 2023, the median GP Ratio of the public companies in the SaaS Capital Index was 13%.

![]()