2023 Benchmarking Metrics for Bootstrapped SaaS Companies

Over the 12 years that SaaS Capital has been conducting its annual survey of private, B2B SaaS company metrics, many patterns have emerged. One is that there is a clear difference between the metrics of VC-backed and bootstrapped companies.

Overall, VC-backed funding is generally correlated with growth. It may not be a causal relationship, but there has been a historical relationship. VC-backed companies are typically operating at a loss to support that growth. Meanwhile, bootstrapped companies tend to show lower growth rates but are generally spending less and are profitable.

There is a healthy debate to be had about whether a SaaS company should seek to raise VC funding or go the bootstrapped route. Much of that though really depends on company specifics and the goals of the founders.

SaaS Capital works with both VC-backed and bootstrapped SaaS companies and has seen the advantages of both approaches. However, one situation that is especially interesting is bootstrapped SaaS companies with $3M to $20M in Annualized Run Rate Revenue (ARR).

Growing from a pre-revenue startup to $3M (scale-up phase) marks a significant shift and bootstrapping from $3M to $20M creates enormous value for owners. To help support bootstrappers during their scale-up, we wanted to focus on benchmarking metrics for scale-up stage bootstrapped SaaS companies.

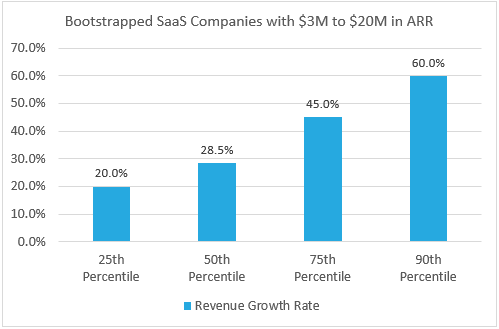

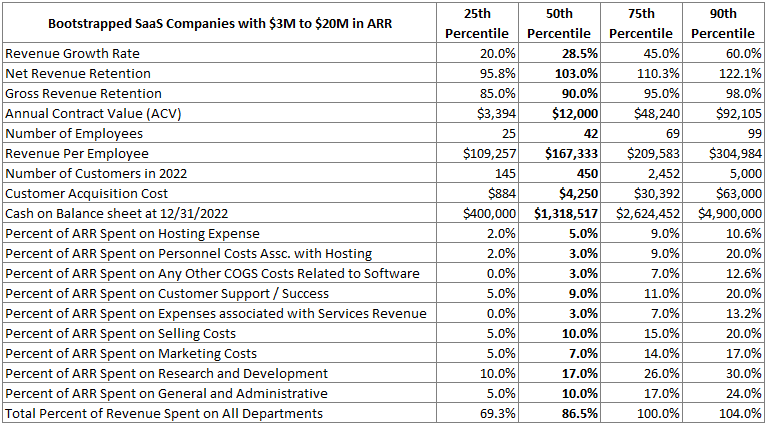

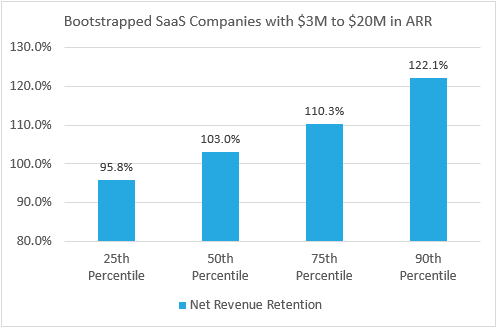

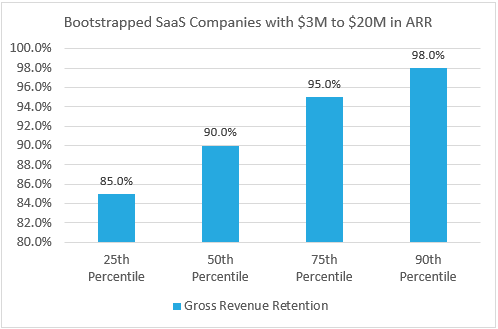

The data above comes from this year’s survey of more than 1,500 private SaaS companies. To help founders and CEOs of bootstrapped SaaS companies understand how their company compares to their peers, we used percentiles to describe the range of the data. A few key metrics:

The median growth rate for bootstrapped SaaS companies with $3M to $20M in ARR is 28.5% while those in the 90th percentile are growing by 60%.

The median Net Revenue Retention (NRR) for bootstrapped SaaS companies with $3M to $20M in ARR is 103% while those in the 90th percentile report NRR of 122.1%.

The median gross revenue retention for bootstrapped SaaS companies with $3M to $20M in ARR is 90% while those in the 90th percentile report gross retention of 98%.

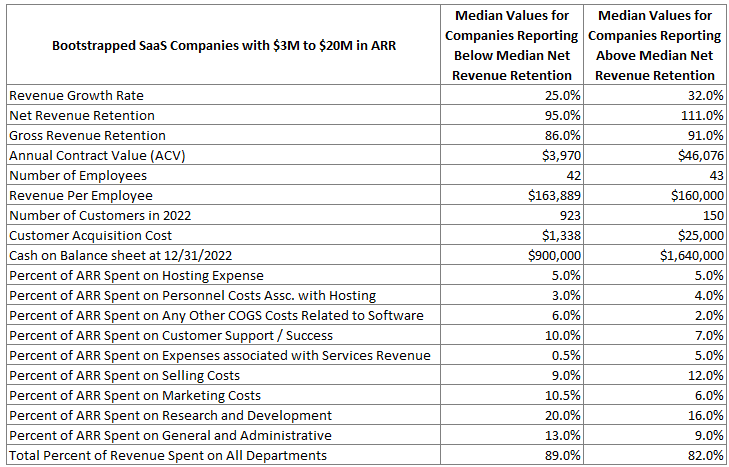

The table above compares companies reporting NRR of more than 1 percentage point below median revenue retention for bootstrapped companies (103%) to those reporting NRR of more than 1 percentage point above-median net revenue retention. This breakdown highlights the relationship between net retention and growth where companies with high net retention are able to post higher growth. Companies with below-median net retention also report below-median growth. The table also reinforces conclusions from previous research on retention that higher retention is associated with higher ACVs.

Conclusion

The scale-up phase offers a tremendous value-creation opportunity for the founders of bootstrapped SaaS companies. In addition, many bootstrapped companies are operating near breakeven, or are profitable, which avoids the need to pivot from the “growth at all costs” mindset during times of uncertainty. We hope these benchmarking metrics offer a valuable resource for the founders and CEOs of bootstrapped companies.

![]()