Insurance Digital Transformation: Three Real Cases

Many are obsessed with automation in insurance these days, but as a fintech researcher, I know first-hand how hard it is to find realistic implementation scenarios and case studies supported by concrete results. That’s why I’m sharing these three digital transformation cases, as seen through the eyes of managers who worked with the new software directly. Behind each story are the real projects that have brought tangible benefits for insurance companies. My colleagues who led these projects to success agreed to share some of their best practices to help you better plan your digital journey.

Case 1: Customer Self-Service Cuts Agent Workload 2x, Intelligent Bots Handle 80%+ of Routine Tasks

Brian is an operations manager at a US health insurance agency. In spite of various optimization attempts Brian took, his team’s workflows evolve into an unsustainable cycle, requiring an ever-increasing number of hands to manage the loose ends, particularly in the late 2010s and during the COVID-19 pandemic. Agents were overwhelmed with calls and emails, and with their outdated software, basic tasks like updating insured info and preparing underwriting files consumed hours. Open enrollment periods tested the team’s limits. Queues grew long, frustrations flared, and both customers and agents often left the process feeling drained. Brian decided it was time for a major change, which would mean technology-powered transformations. He decided to start with the entry point of the insurance cycle that faced the biggest traffic — customer service.

In less than six months after Brian started implementing digital customer self-service, agents saw a nearly 2x reduction in daily workload. Intuitive web and mobile apps for policy purchasing and management quickly gained traction among insureds. Moving health program choice and routine application filing to the customer side let Brian reallocate agents’ efforts to higher-value activities like serving insureds with pre-existing conditions and corporate customers. Over time, less than 5% of agents’ customer conversations took place in person. Remote service provisioning spurred higher satisfaction of both agents and insureds and reduced employee burnout. This allowed the firm to steadily grow its customer base and retain its top talent without constantly hiring new employees.

Sample interfaces of a mobile self-service app by ScienceSoft

After the success of introducing self-service for insureds, Brian got the green light for more initiatives in the following years, so they started rolling out AI tools next. AI-powered analytics for digital selling platforms helped optimize the agents’ efforts and improve digital customer experience. Smart algorithms help tailor the displayed app contents, search results, and product recommendations to the preferences and actions of each use. This resulted in an 80%+ increase in customer retention and 90% higher engagement, while the sales team saw minimized consultative involvement across low-risk mass-market products.

AI-supported virtual assistants made all the difference in agent capacity and sales process speed. Since the company replaced its conventional chatbots with advanced virtual agents powered by large language models (LLMs), insureds can now interact with bots using natural language and get real-time advice at every enrollment stage. Intelligent bots process around 80% of textual and voice customer inquiries and autonomously handle cold calls.

The sales team is now mostly involved in complex, non-trivial health policy selling scenarios. Their smart copilot automatically processes customer documents for KYC checks and pre-writing, instantly synthesizes underwriting files and customer interaction notes, generates tailored quotes and policies, and aids sales managers in planning the team’s work tasks. After the company completed a massive revamp of its agent workflow automation system, agents can perform their sales, quoting, policy issuance, and reporting tasks 2.5–75x faster, so operational delays have become a thing of the past.

What you need to transform sales in insurance

Zaryna Babko, Insurance IT Consultant and Lead Business Analyst at ScienceSoft, shares her advice:

Equip your agents with a mobile toolkit

An intuitive mobile toolkit will let your agents quickly access the required data, update customer information, provide quotes, and record claim details while in the field. If you develop a dedicated mobile agent app, you can add features for native damage photo/video making, sketching, and mapping, but the app would cost $120,000–$180,000. A budget-friendly alternative would be building a web-based agent app with responsive layouts for mobile.

Automate insured-side operations

Self-service automation will remove friction for your digital customers. For example, applying intelligent image analysis to capture data from documents and auto-populate application forms enables data provisioning in seconds. Policy auto-renewals and scheduled premium auto-deductions reduce the cognitive load on insureds and drive retention. If you offer both web and mobile apps, consider an auto-login feature for quick user authentication.

Prioritize custom GenAI assistants

Plug-and-play bots may be an option for automating basic customer support and advisory. However, if you want to introduce in-depth contextual assistance across your specific products and services, you’ll likely need to build a custom chatbot. Services like Azure OpenAI Service and Amazon Bedrock offer go-to toolkits for developing secure generative AI chatbots. Based on my estimates, building a custom assistant may cost somewhere from $200,000 to $350,000.

Check and analyze bots’ responses

Even the smartest AI bots are imperfect, so you need robust controls to ensure customers get accurate, relevant, and unbiased responses. Adding continuous validation tools like IBM AI Fairness 360, Microsoft Guidance, or Guardrails will help you quickly recognize flawed chatbot outputs and tune the solutions accordingly.

Check similar projects on digital insurance sales

Case 2: LLMs Reduce Time to Quote by 12x, AI-Supported Risk Profiling to Drive 50% Growth in Profitability

Lisa is an underwriting manager at a US fleet insurance company. Back in the day, Lisa’s underwriting team used to spend over a third of their work time manually processing risk-relevant information. With siloed data, tedious application screenings, and complicated risk profiling, the quoting and binding processes took ages. Extensive communication burdened the team further at every writing stage.

Replacing legacy underwriting technology with a modern tool stack was not a quick process for Lisa’s company. As her department’s lead, Lisa helped business analysts engineer requirements for the new solution and was responsible for designing an underwriter training program to ensure smooth adoption of the new toolkit. Finally, after 20+ months of steady efforts, Lisa’s team met the new underwriting software.

The software was connected directly to corporate systems and external risk data sources, and its microservices architecture ensured easy development of new integrations. Since the solution was built on modern cloud standards, it could scale on demand. For Lisa’s team, this meant immediate access to the latest risk-relevant information and smooth processing of growing risk data volumes. The team can now manage the entire underwriting flow through one centralized interface with no need to switch between disparate tools and re-enter data. Incorporating LLMs into the loop removed underwriters’ biggest operational hurdles — summarizing multi-source risk data and filling out quote and bind documentation.

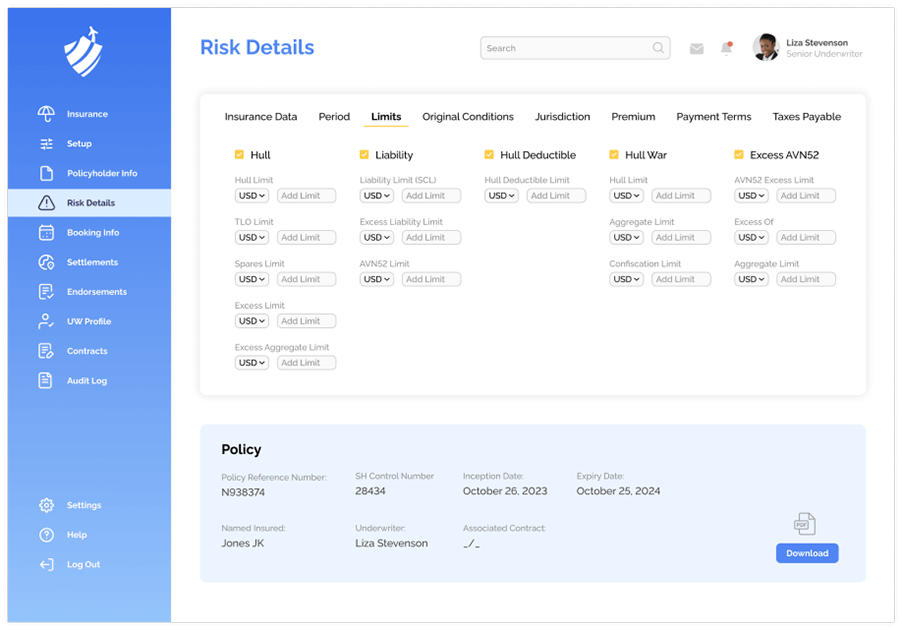

Sample interfaces of an underwriting automation system by ScienceSoft

Albeit the new automation system brought an over 2x increase in productivity and accelerated time to quote by 12x, maximizing risk assessment accuracy and pricing profitability is still the central part of an underwriter’s job. That’s where AI-powered analytics came into play. Custom machine learning and deep learning models precisely predict insured risks and suggest the optimal premiums tailored to risk and demand profiles.

After a year of pilot runs and several improvements to the AI model for better precision, over 90% of applications across personal and small business lines are processed fully automatically, and initial quotes for non-standard products are produced in seconds. Given the early financial outcomes, Lisa’s management expects up to a 50% growth in business profitability over five years due to optimized operational costs and sharper risk pricing.

As the adoption of IoT devices among customers and partners widened, usage-based insurance became the new norm for vehicle insurance lines. Lisa’s underwriting system now captures and processes real-time telematics from versatile vehicle devices. The software analyzes risks dynamically and auto-recalculates premiums based on the fleet state and drivers’ behaviors, ensuring fair personalized pricing and giving insureds more control over their coverage costs.

Lisa’s team is now largely focused on customer consulting on risk mitigation. Having access to insights into potential perils, underwriters take part in spotting high-risk scenarios and mapping the optimal courses of action to prevent potential losses. Thanks to their proactive advice, corporate customers can construct more informed fleet risk management strategies and diminish the impact of severe events. This drives customer loyalty and aligns with the firm’s plan to avoid competing solely on price.

How to succeed in digital transformation for underwriting

Practical advice from Olga Vinichuk, Insurance IT Consultant and Lead Business Analyst at ScienceSoft:

Start with an AI-ready data infrastructure

You should plan tactics and tools to securely access, process, validate, and store insureds’ risk data from various sources. A scalable data lake, a data warehouse with staging pipelines, predictive AI models, BI OLAP cubes, and an analytical app are the basic components of a data infrastructure for comprehensive risk analytics. API-first infrastructure design greatly contributes to data interoperability, while employing modular architectures helps accommodate new risk data sources over time.

Balance AI accuracy and transparency

To safely bring AI into risk assessment, you must meet regulatory requirements for impartial and traceable risk scoring. It’s all about achieving high accuracy and sufficient transparency in risk prediction models. One way to balance these aspects is to combine less sophisticated interpretable AI algorithms with high-precision deep learning models. There’s no unified “golden middle” way to do it, so ScienceSoft defines the optimal combo for each new case. Our data scientists train the models on the latest NAIC and FIO guidelines to prevent erroneous and biased risk ratings. LIME and SHAP are two interpretability techniques we commonly use to reveal the logic behind AI outputs.

Use low- and no-code platforms for rule-based tasks

Automating through AI is not a panacea for efficient underwriting. Most policy pricing operations, for example, do not require machine intelligence but would benefit greatly from easy-to-modify automation rules and a faultless rule execution engine. From this perspective, building underwriting software based on a low-/no-code platform like Microsoft Power Apps would be a reasonable investment in both agility and accurate performance. A no-code logic editor would let underwriters swiftly adjust the rules for automated risk scoring and premium calculation without involving software engineers.

Check similar projects on digital insurance underwriting

Case 3: Simple Claims Are Auto-Resolved in Minutes, Intelligent Processing Boosts Productivity by 35%+

The last few years have been exciting for Eric as a senior claims manager at a multi-line insurance company. More than half of his team’s conventional activities, including the daunting claim evidence processing tasks, have been automated. Other, more complex functions like multi-party settlement and dispute resolution have been simplified significantly due to new intelligent analytics tools. On the one hand, Eric’s team breathed a collective sigh of relief and could finally focus on more challenging tasks left on the back burner. On the other hand, Eric had to reconsider team member responsibilities and reallocate workloads adequately to avoid unnecessary layoffs. Although the new processes led to some unavoidable dismissals, over time, they translated into a 30% decrease in claim processing costs and over a 35% increase in the team’s productivity.

Eric’s company opted for an incremental revamp of its legacy claim tool to balance the innovation pace with budget restrictions and operational continuity. Implementing intelligent automation at scale was the toughest task, as it entailed massive changes to the company’s data infrastructure and established workflows. Eric advocated piloting AI across the P&C lines before large-scale rollouts; he believed focusing on AI applications that brought quick and tangible benefits would help minimize technology risks and build claim specialists’ trust in AI. Although complex initiatives like automated settlement for commercial claims were postponed, the company made notable progress using AI for data processing and fraud detection.

The new AI-powered claim management software enables straight-through processing for simple claims and aids Eric’s team in resolving complex cases. Once a customer submits the first notice of loss and supporting documents via a self-service app, the files get immediately transferred to the claim system’s back end for processing. LLM algorithms automatically extract and summarize claim data for further decisioning, accelerating initial claim review by over 50x. Moreover, LLMs scan the web and augment claims with additional data like public sentiment, shedding light on non-apparent claim details.

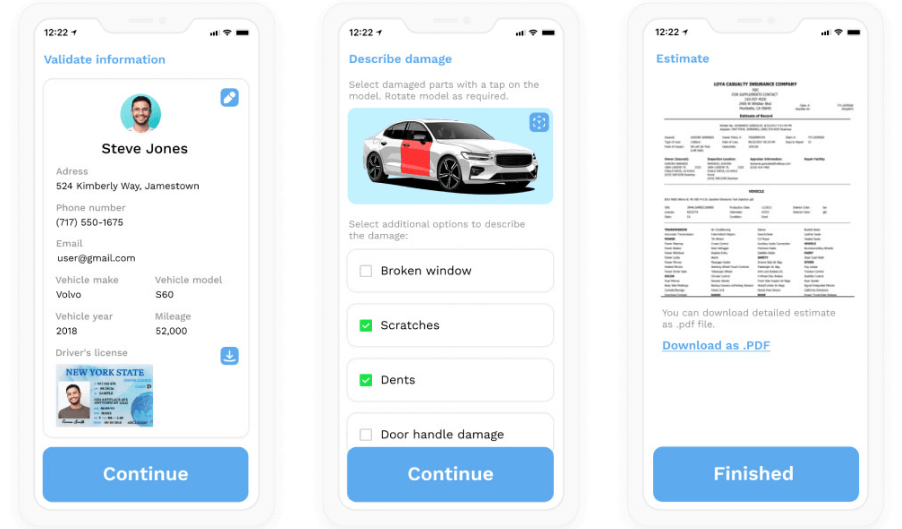

Sample interfaces of a vehicle claim self-filing app by ScienceSoft

Machine learning models inspect multi-format loss evidence (including voice recordings, video, and IoT device readings) and spot forgery. Quick and accurate (95%+) fraud detection minimized undue payouts, which alone brought Eric’s company a 5%+ increase in profitability.

Valid claims get triaged and routed to the appropriate resolution pipelines automatically. Rule-based and intelligent algorithms produce decisions for predictable cases in minutes and instantly communicate compensation details to claimants and settlement specialists. Eric’s team performs random checks of machine decisions to ensure technology operates as intended.

Nuanced and unusual claims that require expert judgment are submitted to Eric’s team for manual resolution. For such claims, ML algorithms analyze claim evidence and produce initial damage estimates, equipping claim specialists with insights for further negotiations. Intelligent copilots assist the team members in searching for information, preparing loss adjustment documents, and planning interactions. Now that the company’s claim management software is securely integrated with the internal systems of its corporate customers, loss-handling partners, and reinsurers, Eric’s team enjoys frictionless collaboration, where most of the data capture and sharing is automated.

Just like in Lisa’s case, Eric’s department now works at the intersection of risk monitoring and consulting, with an explicit focus on dynamic diagnosis of emerging perils and compensation planning. An AI-powered predictive engine continuously analyzes risk data coming from external sources and notifies claim specialists when loss probability exceeds the preset thresholds. The proliferation of IoT and exponential growth in real-time risk data gave rise to new use cases for the parametric insurance model. Once offered by the company specifically for flood insurance, the model is now applied across property, travel, and specialized commercial lines. Parametric payouts are triggered automatically based on risk levels, with no need for customers to file claims and for Eric’s team to engage in loss adjustment flows.

Inspired by the success of Lemonade’s blockchain-supported products, the company is now considering smart contracts as a way to establish instant and fully automated payouts.

Practices to succeed in the digital transformation of claims management

Olga Vinichuk, Insurance IT Consultant and Lead Business Analyst at ScienceSoft, shares her expertise:

Consider alternative software architectures

Your automated processing system must be scalable enough to accommodate temporary claim spikes — for example, during severe catastrophic events. Building claims software on a cloud microservices architecture is a proven way to secure high scalability. At ScienceSoft, however, we never overlook the alternatives that could help further reduce costs. For example, in our SaaS project for Brush Claims, we initially opted for microservices but ended up using a distributed monolith architecture. This option was way more affordable but still ensured the solution’s easy maintainability and scalability.

Adopt AI for fraud detection

Advancements in AI deepfakes spurred a rise in realistic faked claim evidence, including sophisticated ones like professional documents, medical images, incident videos, and witness voice records. Battling AI with AI is, for now, the only feasible way to address emerging forgery schemes. If you focus on specialized commercial insurance and do not plan large-scale digital transformation, consider at least a dedicated AI module for multi-format evidence validation. In my practice, launching a standalone intelligent fraud detection component may cost around $80,000–$200,000 and bring up to a 10x ROI.

Check similar projects on digital insurance claim processing

Start Digital Transformation in the Near Term – And Be Ready to Sustain It

Compared to other finance sectors, the pace of digital transformation in the insurance industry may seem frustratingly slow. However, this creates a fair opportunity for every insurance company to capitalize on pragmatic digital initiatives and gain a long-lasting competitive edge in its niche.

As ScienceSoft’s experience shows, if digital transformation is planned appropriately, nearly everything can be automated. Yet, you should be ready to sustain the gradual transformation process for 1–5 years and invest $200,000–$1,500,000 a year for steady progress. If such investments are way beyond your budget, start with small but high-impact initiatives like implementing customer self-service tools or document processing automation. This way, you’ll be able to quickly cut operational expenses and accumulate the freed resources for larger-scale projects.

If you need assistance at any stage of implementing your digital initiatives, don’t hesitate to turn to ScienceSoft’s consultants for advice, troubleshooting, and actionable solutions.