Should discounts be included in MRR?

78% of SaaS businesses offer discounts, according to a poll by SaaStr. Since discounts are a staple in SaaS, founders often ask, “How should MRR be calculated for discounted customers? Should MRR be reported gross or net of discounts?”

Spoiler: I don’t think discounts should be included in MRR, and here’s why.

MRR should be representative of what customers are paying

Monthly recurring revenue is exactly that–revenue you expect to generate each month for delivering value to customers. If a customer has a 20% discount, you’re generating 20% less revenue. Why would your MRR calculation ignore this discount?

Not all discounts are created equally. Some might last one month, some might last forever (though we strongly advise against lifetime discounts), and discounts can come in the form of a percentage or fixed dollar amount.

The below example illustrates the issue this creates in calculating MRR

Imagine 3 customers:

Customer A pays $500/month

Customer B pays $400/month on the same plan with a 20% discount for 3 months

Customer C pays $400/month on the same plan with 20% discount forever

Reporting Customer C at $500 MRR would be a misrepresentation. They have a lifetime discount and you’re never expected to receive that much revenue from them. If Customer B renews post-discount, they’ll start paying $500/m. The problem with reporting Customer B at $500 MRR today is you’re creating inconsistencies in how discounts impact your MRR.

MRR is the predictable revenue generated in a given month

For consistency, I’d recommend calculating this MRR as (A) $500 + (B) $400 for 3-months that shifts to $500 after that discount expires + (C) $400.

Particularly in cases where discounting is a common practice, there may be a significant delta between reported MRR and what customers are actually paying. Not removing discounts before calculating MRR can misrepresent the health of a business to your team, board, and future investors.

A discounted subscription might be more challenging to renew at full cost than a customer already paying full price. If the value your product delivers to a customer doesn’t change but their price increases, for example, 25%, it might be dangerous to assume that the customer is just as likely to renew as a customer already paying full price.

You can use a tool like ChartMogul to understand the impact that discounts have on your ability to retain customers.

Expansion MRR

A subscription renewing after a discount is removed will result in expansion MRR. This can help offset churn and contraction from other customers. Net retention rate (NRR) is an important metric in evaluating the health of a business, particularly in 2025 when new business growth has slowed considerably.

NRR reports what percentage of revenue you’re retaining for a given period from existing subscribers, taking expansion into account.

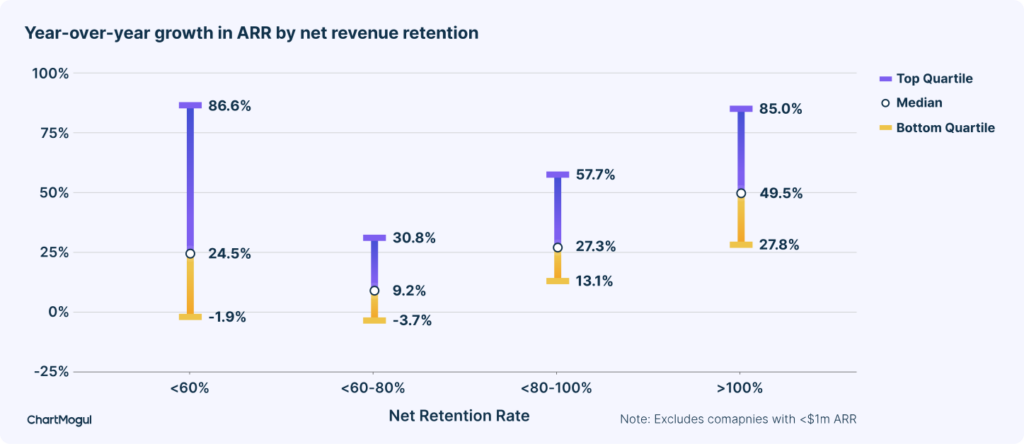

In our SaaS Benchmark Report, we reported that the median business with an NRR of 60–80% grew by 9.2%. At companies where net retention exceeded 100%, median growth reached 49.5%.

Reporting MRR using ChartMogul

Nearly half of the prospective customers that I speak to are using Stripe for subscription management, and most of them are relying on Stripe’s subscription analytics reporting as well. When they can no longer rely on Stripe’s reporting and start evaluating ChartMogul, there is often an MRR discrepancy between Stripe and ChartMogul. Stripe gives the option for reporting MRR gross or net of discounts, and this is typically the main cause of the discrepancy. As you can probably guess if you’ve read this far, ChartMogul only reports MRR net of discounts.

In most cases, these businesses have been reporting MRR to their investors and team without removing discounts. This poses an initial hurdle to adopting ChartMogul, because they may have to report a 10%+ change in their MRR.

Reporting MRR net of discounts provides a more accurate and honest reflection of the health of your subscription business. By reporting on real, recurring revenue, you can make smarter decisions based on what customers are actually paying.